Key Takeaways

- Best interest rates savings accounts: CFG Bank, Popular Direct, Salem Five Direct, TAB Bank, TotalDirectBank, UFB Direct, Vio Bank, and Western State Bank provide attractive interest rates.

- Best high yield savings accounts: CFG Bank, Dollar Savings Direct, Evergreen Bank Group, My Banking Direct, Newtek Bank, ONE, Popular Direct, Salem Five Direct, TAB Bank, TotalDirectBank, UFB Direct, Valley Direct, Vio Bank, VirtualBank, and Western State Bank offer high APY rates.

- Best interest rates certificate of deposit: Bank5 Connect, CIBC Bank USA, Colorado Federal Savings Bank, Connexus Credit Union, First Internet Bank of Indiana, LendingClub, Merrick Bank, and Popular Direct provide competitive interest rates.

- Best interest rates money market accounts: CFG Community Bank, iGOBanking.com, Quontic Bank, UFB Direct, and Vio Bank offer attractive APY rates.

Disclaimer

Several factors, including the actions of the Federal Reserve, can influence interest rates. However, it's important to note that the changes in interest rates may not be immediately reflected within the data presented on this page.

Moreover, the contents of this article are for educational purposes only. They are not intended to be a source of professional financial advice. You will find experts on financial planning and financial management here. More on disclaimers here.

Top credit unions with best interest rates

If you're in the market for a bank or credit union that offers competitive interest rates, here are some of the top institutions in the country to consider:

Alliant Credit Union

- Offers above-average interest rates for savings.

- Membership is open to all, and you can join with a $5 donation to a nonprofit.

- Highly rated mobile app and access to a fee-free network of 80,000 ATMs.

Consumers Credit Union

- Provides extremely high interest rates on checking accounts, subject to activity requirements.

- Reimburses fees incurred at out-of-network ATMs for members.

- Open membership with a $5 fee and a minimum $5 deposit in a savings account.

Navy Federal Credit Union

- Boasts around 300 branches and a strong customer service reputation.

- Offers free checking accounts.

- Membership open to military members (active-duty, veterans, and their immediate family), Department of Defense employees, and retirees.

Connexus Credit Union

- Features free checking accounts and access to a network of 54,000 fee-free ATMs.

- Eligible for refunds on out-of-network ATM fees.

- Membership available through a $5 donation to the Connexus Association, an education organization.

First Tech Federal Credit Union

- Provides a fee-free checking account with competitive interest rates.

- Offers one of the highest interest rates for kids' savings accounts.

- Open membership after becoming a member of a financial education nonprofit (membership costs $8).

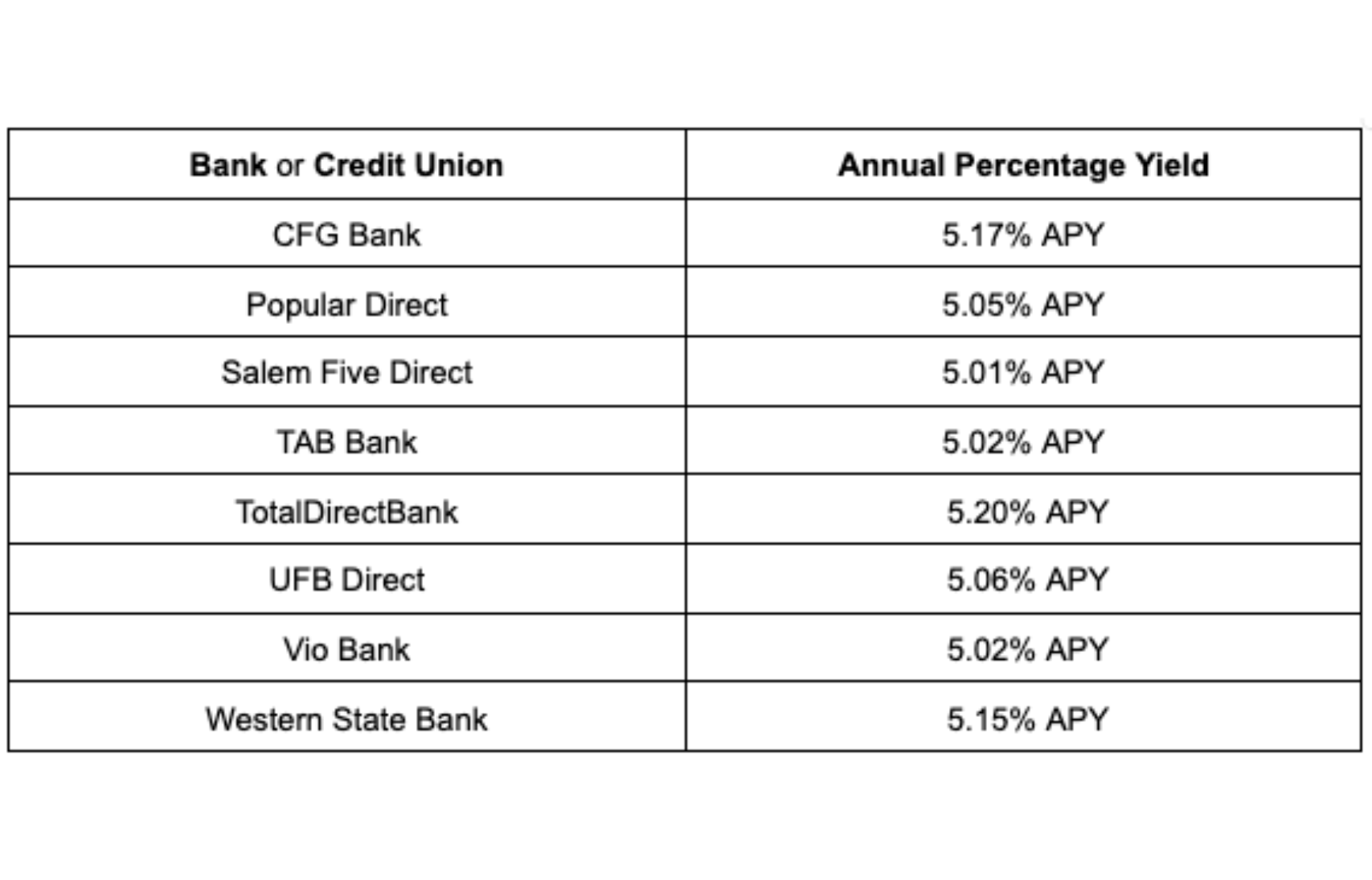

Best interest rates savings accounts

While these banks have minimum balance requirement for opening an account, they also offer some of the highest interest savings rates:

| Financial Institution | Interest Rate |

|---|---|

| CFG Bank | 5.17% APY |

| Popular Direct | 5.05% APY |

| Salem Five Direct | 5.01% APY |

| TAB Bank | 5.02% APY |

| TotalDirectBank | 5.20% APY |

| UFB Direct | 5.06% APY |

| Vio Bank | 5.02% APY |

| Western State Bank | 5.15% APY |

Popular online banks and credit unions

These are some of the most popular banks and credit unions which provide online services:

- Ally Bank

- American Express National Bank

- Axos Bank

- Bank5 Connect

- Bank of America Financial Center

- Capital One

- CIT Bank

- Connexus Credit Union

- Discover Bank

- Pentagon Federal Credit Union

- Quontic Bank

- Rising Bank

- SoFi

- TIAA Bank

- Wells Fargo Bank

Banks with best high-yield online savings accounts

These financial institutions offer the best online savings account:

- Ally Bank

- CIT Bank

- Barclays

- Capital One

- Discover Bank

- Ally Financial

- Capital One Bank

- Live Oak Bank

- TIAA Bank

Types of bank savings accounts

The options include:

- Traditional savings accounts

- High-yield savings accounts

- Money market accounts

- Certificates of deposit

- Cash management accounts, and

- Specialty savings accounts.

How to open an account with the best interest rates

To open an account with the best interest rates, follow these steps:

Step 1: Research: Compare interest rates offered by various banks or financial institutions.

Step 2: Choose the Right Account: Select an account type that aligns with your financial goals (e.g., savings, certificate of deposit, money market account).

Step 3: Check Requirements: Ensure you meet any minimum deposit or account maintenance requirements.

Step 4: Online vs. In-Person: Decide whether you prefer to open the account online or visit a local branch.

Step 5: Gather Documents: Prepare necessary identification and financial documents.

Step 6: Complete Application: Fill out the account application with accurate information.

Step 7: the Account: Deposit the required initial amount into the account.

Step 8: Verify Details: Review all the details before finalizing the account opening process.

Step 9: Stay Informed: Monitor your account regularly and take advantage of any interest rate changes or promotions.

Remember, interest rates can vary over time, so it's essential to review your options periodically and consider factors beyond just the interest rate, such as account fees and customer service.

How to address savings account interest changes

The rates on high-interest savings accounts can go up or down anytime, and sometimes it can happen suddenly without warning.So, when you open your savings account at one rate, it likely won't stay at that rate forever. The bank can decide to change the rates, and it depends on various factors. Some of these factors include changes in the Federal funds rate, the overall economic conditions, and if the bank needs more deposits.

When you have a loan for a longer period, you end up paying more interest. So, if your loan lets you extend the time instead of increasing the monthly installment (EMI) amount, it's still better to choose the higher EMI option if interest rates are rising. If possible, do not increase the tenure and try to pay off the higher EMI.

Other things to watch out for are monthly maintenance fees and sometimes excessive transactions fee. These monthly fees can depreciate interests when too high. So you should pick an account type that has a fair balance between its monthly fee and its annual percentage yield (APY).

High-yield savings account vs. traditional savings account

The most significant distinction lies in the interest rate, commonly referred to as the annual percentage yield (APY). The APY represents the interest you accumulate on your savings within a year. While a traditional savings account typically earns around 0.01% to 0.35% on your account balance, a high-yield savings account offers substantially higher returns.

High-yield savings account vs. certificate of deposit (CD)

High-yield savings accounts, along with standard savings accounts, typically feature variable interest rates that can fluctuate at any point, whereas CDs (Certificates of Deposit) offer a fixed interest rate for a specified term, such as one or five years.

CDs generally provide higher interest rates compared to high-yield savings accounts, but they operate differently. When you open a CD, you usually deposit a lump sum of money and commit to keeping it untouched for the chosen term. At the end of the term, you can withdraw both the principal amount and the interest earned without incurring any penalties.

Alternatives to a high-interest savings account

Consider any of these when exploring other investment options instead of a high-interest savings account:

Fixed Savings for Higher & Stable Returns: Consider fixed savings options that provide higher and more consistent returns over a specified period.

High-Risk Returns on Stocks: If you are willing to take on higher risks, investing in stocks can offer potentially lucrative returns.

Investing in Bonds: Bonds can be a reliable investment choice, offering steady income streams and varying risk levels.

Investing in Real Estate: Real estate investment can provide both rental income and potential property appreciation.

Gold as a Diversification Option: Including gold in your investment portfolio can act as a diversification strategy and serve as a hedge against market volatility.

Utilizing Loans for Strategic Investments: In some cases, strategic borrowing can be used to fund promising investment opportunities and potentially yield significant returns.

How do I close a bank account?

This is a way you could go about closing a bank account:

Open a New Account: Start by opening a new bank account at the financial institution of your choice.

Switch Your Scheduled Payments and Deposits: Ensure that all your existing scheduled payments and deposits are updated with the new account information.

Transfer Your Money: Transfer all funds from your current bank account to the new one.

Contact Your Bank: Reach out to your bank through a call to the customer service or visit your local branch to initiate the account closure process.

Follow the Bank's Procedure: Depending on the bank's policy, you may be required to fill out certain forms or provide specific information to close the account.

Written Confirmation: Request written confirmation that your bank account has been successfully closed.

Note: Some banks may offer online account closure options, but it's essential to check with your bank to understand the preferred method. In many cases, visiting a branch in person is required to complete the account closure and withdraw any remaining funds.

Where can I get 7% interest on my savings?

Currently, Landmark Credit Union stands out as the sole financial institution offering an interest rate of at least 7% APY on a savings account.

Mango Money is another option, providing up to 6% APY on the Mango Savings account. To get started, you'll need to open a Mango Card, a prepaid debit card. There's no credit check required, and no activation fee. Moreover, anyone with a card can open a savings account by depositing just $25.

If you're looking for a savings account that offers 5% interest, it's important to note that there are no accounts with such high rates. However, you might come close by exploring fixed annuities. As of July 2023, annuities guarantee up to 5.45% APY, providing a viable option for potentially higher returns on your savings.

Where can I get 10% interest on my money?

If you're looking for investments with higher interest rates than CDs and MMAs offer, consider investing your funds in these options:

High-End Art (on Masterworks): Experts recommend considering art investment on platforms like Masterworks for potential unexpected gains in 2023.

Private Credit Market: Explore opportunities in the private credit market to potentially secure higher returns on your money.

Gold IRAs: Consider diversifying your portfolio by investing in Gold IRAs, which can act as a hedge against inflation and market volatility.

Paying Down High-Interest Loans: Prioritize paying off high-interest loans to save on interest costs and improve your overall financial position.

Stock Market Investing via Index Funds: Invest in index funds as a way to gain exposure to a diversified portfolio of stocks and potentially earn market returns.

Stock Picking: If you have the expertise and time, consider individual stock picking, but be mindful of the associated risks.

Junk Bonds: Assess the potential of investing in junk bonds, which offer higher yields but come with higher default risk.

Buy an Existing Business: For entrepreneurial-minded individuals, acquiring an existing business may present opportunities for higher returns and growth.

Take advantage of available expertise

If you want to achieve your financial goals faster, it's better to work with experts like financial planners or advisors. They can provide valuable guidance and help you make smart investment decisions that match your goals.

With their expertise, you can simplify your investment plan and increase your chances of reaching your financial targets more easily. Reach out to Bay Street's trusted financial advisor or certified financial planner today for expert advice.

Bay Street Capital Holdings

Situated in Palo Alto, Bay Street Capital Holdings is a prominent wealth management firm specializing in financial planning, wealth management, and investment advisory services. What sets them apart is their unique approach that places emphasis on effectively managing overall risk and volatility, rather than solely pursuing maximum returns.

Under the guidance of the esteemed founder, William Huston, who was honored as one of Investopedia's Top 100 Financial Advisors for 2021, Bay Street stands out as one of the two Black-owned firms among the nineteen recognized in California. For its work in the real estate industry with Resthaven Properties, the firm has been named a finalist in the WealthManagement.com 2023 Industry Awards under the category of Asset Managers: Diversity, Equity and Inclusion.

The company's commitment to fostering diversity and supporting emerging fund managers and entrepreneurs is evident, as demonstrated by their selection as a finalist in the Corporate Social Responsibility (CSR) category for the Asset Manager in 2021. This recognition came after competing against more than 900 firms nationwide, highlighting their dedication to social impact.

Sources

https://www.businessinsider.com/personal-finance/7-percent-interest-savings-accounts#:~:text=Which%20bank%20gives%207%25%20interest%20on%20a%20savings%20 account%3F,%25%20APY%3A%20Landmark%20Credit%20Union.

https://www.wallstreetzen.com/blog/how-to-get-a-10-return-on-investment/

https://money.usnews.com/banking/credit-unions https://www.experian.com/blogs/ask-experian/how-often-do-high-yield-savings-rates-change/#:~:text=Rates%20on%20high%2Dinterest%20savings,stay%20at%20that%20rate%20f orever.

https://finance.yahoo.com/personal-finance/high-yield-savings-account-vs-traditional-savings- account-which-is-better-120024972.html#:~:text=The%20biggest%20difference%20is%20the,earns%20much%20more %20than%20that.