Best Place to Invest in Real Estate in 2024

Owning real estate is a smart investment decision because real estate is one of the most stable asset classes to include in your portfolio. Depending on the type of investment property, real estate can serve as a means to generate passive income and safeguard your wealth against inflation.

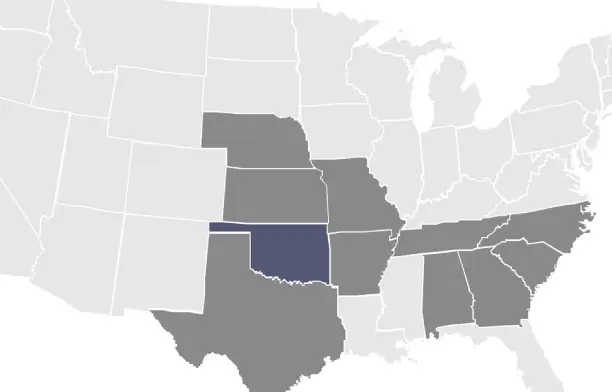

A number of factors come to play in successful investments, however, location is one of the key factors for real estate investing. This blog highlights the best locations for real estate investing in 2024, and discusses some metrics for choosing properties.

William Huston, AIF®, AIFA®

Owning real estate is a smart investment decision because real estate is one of the most stable asset classes to include in your portfolio. Depending on the type of investment property, real estate can serve as a means to generate passive income and safeguard your wealth against inflation.

A number of factors come to play in successful investments, however, location is one of the key factors for real estate investing. This blog highlights the best locations for real estate investing in 2024, and discusses some metrics for choosing properties.

Key Takeaways

- Austin, Texas; Azores, Portugal; Berlin, Germany; Denver, Colorado; Dubai, UAE; Nassau, The Bahamas; Phoenix, Arizona; Singapore; Sydney, Australia; and Toronto, Canada are top destinations for real estate investment.

- Individuals can invest in different property types including residential, commercial, specialized, vacant land, and REITs, each with distinct characteristics and investment potential.

- Factors such as economic trends, population growth, job opportunities, infrastructure development, affordability, and housing market stability influence investment decisions.

- Bay Street's boutique hotel projects in Portugal present prime property investment opportunities for investors to capitalize on the country's thriving tourism and hospitality industries.

Disclaimer

The contents of this article are for educational purposes only. They are not intended to be a source of professional financial advice. You will find experts on investing here.

Promising real estate properties to invest in today

Bay Street Capital Holdings is a wealth and asset management firm. The firm's real estate assets include hotel properties in Lake Tahoe and Los Angeles, as well as boutique hotel projects in four Portuguese cities including Azores, Alentejo, Coimbra, and Minho.

In 2023, Portugal led the rest of Europe in the tourism industry, and has continued on that trajectory. As a result, its hospitality industry has seen unprecedented growth, and Bay Street's boutique hotel projects are perfectly located to take advantage of this growth. These projects have an estimated IRR of 18.87% and are incentivized with 45-55% cashback subsidies from the Portuguese government.

Bay Street's Alt Path Hotel Fund is a platform for US and other nationals to invest in real estate in Portugal's hospitality sector through these projects. Interested investors also gain the advantage of receiving professional guidance for a second residency in Portugal through its Golden Visa program.

Schedule a call today with our team to explore these investment opportunities.

Top picks for real estate investments in 2024

When searching for the best places to invest in real estate in 2024, it's important to consider several factors such as current market trends, economic growth, population growth, job opportunities and infrastructure development.

Using these and other criteria, these are our top pick locations around the world to diversify your portfolio with real estate investments:

1. Austin, Texas, USA: Austin, Texas, has seen remarkable growth in its real estate market and population over the past decade. Tech companies from Silicon Valley have been moving to Austin, attracted by its lower housing prices and rent. With a low unemployment rate of 4.2%, high rental demand, and a booming job market, Austin's housing market is flourishing, leading major tech players like Apple, Samsung, and Tesla to establish significant offices in the city.

2. Azores, Portugal: Real estate in Azores, Portugal has gained attention among investors, thanks to its stunning natural beauty and the growing availability of luxury amenities, particularly in proximity to the capital, Ponta Delgada. The luxury market, especially in Ponta Delgada on the island of Sao Miguel, has seen significant growth in recent years. A surge in the property market in this region is expected in the near future. Bay Street is developing boutique hotels in the Azores to capitalize on this lucrative real estate market there and the broader hospitality boom in Portugal.

3. Berlin, Germany: Germany, Europe's largest economy, offers attractive opportunities for property investment with its growing cities and stable environment. Berlin, the continent's tech hub, continues to attract young professionals and offer diverse opportunities in residential and commercial real estate. Key advantages for real estate investments in Berlin include low property prices, tax incentives, strong rental demand, government subsidies, long-term capital appreciation, and overall stability.

4. Denver, Colorado, USA: Denver, Colorado, is experiencing rapid growth with increasing population and rent prices. With a high percentage of homes occupied by renters, it's a favorable city for rental investors. Denver's buoyant economy, low unemployment rate of 3%, and strong real estate appreciation place it as a promising destination for real estate investment in 2024.

5. Dubai, UAE: The real estate market in the UAE stands out with its impressive offerings including a tax-free environment. With a GDP of £406.46 billion and a population of 9.58 million in 2023, the UAE presents an attractive landscape for investors. In particular, average rental yields of 5.16% and an average property price of £261 per square foot in Dubai underscore its profitability. The combination of a thriving economy and significant returns positions Dubai and the UAE as one of the premier real estate markets globally.

6. Nassau, The Bahamas: Amidst its rich history and natural beauty, Nassau in the Bahamas offers a vibrant real estate market with diverse investment opportunities. Investors are drawn to its tax-friendly environment and stable investment climate. As the capital city, Nassau provides essential services and is home to some historical landmarks, making it an attractive place to live and invest. Navigating the Nassau real estate market involves thorough research, setting realistic budgets, and working with local agents to capitalize on investment potential.

7. Phoenix, Arizona, USA: Phoenix, Arizona, stands out for its rapid economic growth, which is driven by a strong housing market and population expansion. With home value appreciation at 81% and a median home price of $269,175, Phoenix offers affordability and investment potential. Its stable economy, lower cost of living, and favorable climate contribute to its continued growth and attractiveness to residents and investors alike.

8. Singapore: January 2024 marked a shift from the previous year for the real estate market in Singapore, with interest rates peaking, inflation easing, and the S&P 500 reaching record highs. In Singapore, the most favored asset classes are hospitality, co-living, logistics, retail, and office spaces. Additionally, there are niche asset classes such as data centers and self-storage, although these properties are seldom available for sale in the Singaporean market.

9. Sydney, Australia: Sydney's real estate market is booming, with experts advising homebuyers on investment strategies. Despite challenges like high interest rates, rising property values are pleasing homeowners. Some experts recommend focusing on growth areas and hidden gems in the suburbs for more affordable options. Others suggest considering slightly older properties in the Hills District and southwestern Sydney due to rising construction costs.

10. Toronto, Canada: Toronto, a bustling metropolis in Canada, is an example of the country's vibrant multiculturalism and economic vigor. At large, Canada offers a stable housing market with growth potential, making it an attractive destination for property investment. With a robust economy and the people's focus on personal savings, Canada provides stability and growth prospects for investors. Additionally, projected population growth and infrastructure development further strengthens the property market's attractiveness.

Types of real estate properties to invest in

When it comes to real estate investment, there's a wide range of property types to choose from, each with its own unique characteristics and investment potential. Here are some common real estate property types:

Residential properties

Single-family homes: These are standalone houses suitable for individual or family occupancy. They offer stable rental income and potential for long-term appreciation.

Multi-family properties: These include duplexes, triplexes, and apartment buildings, which provide multiple rental units within a single property. They offer economies of scale and diversification of income streams.

Condominiums: Condos are individually owned units within a larger complex or building. They offer amenities and shared maintenance costs, making them attractive for investors seeking hassle-free ownership.

Commercial properties

Office buildings: These properties house businesses and professional services. They offer long-term leases and stable cash flow, but demand may fluctuate with economic conditions.

Retail spaces: Retail properties include shopping malls and individual stores. They cater to businesses selling goods and services to consumers. Location and tenant mix are critical factors for success in retail investments.

Industrial properties: This category includes warehouses, distribution centers, and manufacturing facilities. They benefit from growing e-commerce trends and demand for logistics infrastructure.

Specialized properties

Hospitality: Hotels, resorts, and vacation rentals cater to travelers and tourists. They offer seasonal income opportunities with moderate earnings during low seasons and potential for high returns during peak travel seasons.

Healthcare: Properties such as hospitals, medical offices, and assisted living facilities serve the healthcare sector. They provide essential services and may benefit from demographic trends such as the trend of more people living longer and needing assisted care.

Mixed-use developments: These projects combine residential, commercial, and retail components within a single property. They offer diversification and collaboration for different uses.

Vacant land and development projects

Land investments: Raw land or undeveloped parcels offer opportunities for future development or appreciation. Investors can capitalize on rezoning and infrastructure improvements.

Development projects: Investing in real estate development involves constructing new properties or redeveloping existing ones. It requires thorough market analysis and project management expertise.

Real Estate Investment Trust (REIT)

Real estate investment trusts are companies that own, operate, or finance income-producing real estate, whose shares are publicly traded in the stock market. They offer investors exposure to diverse real estate assets without direct property ownership. REITs provide liquidity, portfolio diversification, and potential for attractive returns through dividends and capital appreciation.

Similarly, investors can explore mutual funds that diversify into real estate, or use online real estate platforms such as crowdfunding platforms to invest in unique investment properties.

Learn more about real estate investing here.

Factors that contribute to a location's investment potential

As a real estate investor, you should consider various factors when selecting real estate properties, including location, rental income potential, appreciation prospects, financing options, and risk tolerance. Besides, macroeconomic factors that form the larger context for real estate investments are also worthy of consideration.

Economic and market trends

The real estate market is deeply intertwined with broader economic trends. In 2024, we're witnessing a dynamic environment shaped by factors such as inflation rates, interest rates, and global economic conditions. Despite uncertainties, certain trends stand out, such as the continued rise of remote work and the growing importance of sustainability in development projects. These trends influence where people choose to live and work, directly impacting real estate demand and investment opportunities.

Population growth and demographics

Population growth is a key driver of real estate demand, particularly in urban areas. Cities experiencing rapid population growth often see increased demand for housing and commercial properties. Over the last few years and still continuing, there's been demographic shifts driven by factors like migration patterns, birth rates, and aging populations. Investors should pay attention to regions with youthful populations, as they tend to drive economic growth and demand for various property types.

Job opportunities and employment growth

Strong job markets are essential for sustainable real estate investment. Cities with diverse economies and strong employment growth tend to offer attractive investment opportunities. In 2024, industries like technology, healthcare, and renewable energy continue to fuel job creation in certain regions. Investors should focus on areas where these industries are thriving, as they often generate demand for both residential and commercial properties.

Infrastructure development

Infrastructure plays a crucial role in shaping real estate markets. Investments in transportation, utilities, and public amenities can significantly impact property values and investment prospects. In an election year in the US and other key places around the world, governments and private investors allocate substantial funds towards infrastructure projects aimed at improving connectivity, sustainability, and quality of life. Areas undergoing significant infrastructure development present promising opportunities for real estate investors.

Affordability and housing market stability

Affordability is a key consideration for both homebuyers and real estate investors. In markets where housing prices outpace income growth, affordability becomes a concern, potentially leading to market instability. In 2024, investors should carefully evaluate housing market fundamentals, including supply-demand dynamics, affordability metrics, and potential risks such as speculative bubbles or regulatory changes.

Other considerations for property selection

Your investment strategy and objectives dictate the ideal property type and location for your investment. For example, for investors seeking passive income, rental properties in metropolitan areas are preferable. A rental property in a metropolitan area has the potential for high rental income and high occupancy rates, low tenant default rates, and they benefit from population and job growth.

Additionally, it's essential to consider the impact of property taxes on the overall investment performance. Conducting thorough due diligence and seeking professional advice can help investors make informed decisions aligned with their investment goals and objectives. It is also important to work with an experienced real estate agent.

Schedule a call with Ila, an experience Realtor, for topnotch real estate services.

Invest in boutique hotels in high-tourist Portugal

Here's an opportunity to narrow down your search and cut down your search time. With strategic locations and unique designs that capture the essence of each locality, Bay Street's boutique hotel projects capitalize on Portugal's booming tourism and hospitality industries. Take advantage of this prime opportunity in 2024.

Invest in Bay Street's boutique hotel projects in high-tourist Portugal. Schedule a call with our team today.

Sources

https://www.doorloop.com/blog/best-real-estate-markets-2022

https://yieldinvesting.co.uk/best-place-to-invest-in-property-worldwide/

WHAT WE'RE THINKING

Let's Talk

Schedule a complimentary consultation with one of our advisors to learn more about Bay Street and how we can help you achieve your goals for your financial future.