Wealth Manager Vs. Financial Advisor

In the realm of personal finance, the roles of wealth managers and financial advisors are often discussed. While they share the common goal of helping individuals achieve their financial objectives, there are important distinctions between the two.

In this blog post, we will explore the differences and similarities between wealth managers and financial advisors, providing clarity on how each can contribute to your financial success. By understanding their unique approaches, you can make informed choices about the type of financial professional that best suits your needs.

Beyond this blog, if you have questions you would prefer answered by an actual professional, our financial advisor is available to take your questions.

Key Takeaways

- Wealth managers specialize in managing the assets of high-net-worth individuals and provide comprehensive wealth management services, while financial advisors serve a broader range of clients and offer diverse financial services tailored to specific goals.

- Wealth managers typically require a higher minimum investment compared to financial advisors.

- Wealth managers often work with professionals in related areas such as tax professionals and attorneys to design comprehensive wealth-planning strategies for their clients.

- Financial advisors may have lower fees compared to wealth managers, with wealth managers charging higher fees for their specialized and comprehensive services.

Disclaimer

The contents of this article are for educational purposes only. They are not intended to be a source of professional financial advice. You will find experts on financial planning and financial management here. More on disclaimers here.

In need of a team for all your financial needs?

If you are in need of a team that provides services based on a holistic understanding of financial planning and wealth building process, then you should open a conversation with the team Bay Street, which includes both a financial advisor and a certified financial planner. Seize this unique opportunity to shape your financial future positively. Work with one of the best financial planning firms in North America and take advantage of our excellent financial planning services.

Who and what is a financial advisor?

A financial advisor is an individual who offers professional guidance and advice to clients regarding various aspects of their finances, including personal money management and investment decisions. These advisors can either work independently or as part of a larger financial institution, providing expertise tailored to the specific needs and goals of their clients.

What Do Financial Advisors Do?

A financial advisor assists individuals in developing long-term wealth-building strategies and managing risk. Many of them provide private wealth management services including investment management services. They offer expertise in tracking, managing, and balancing investment portfolios, while also providing valuable guidance on various financial matters and decision-making processes.

Who is a wealth manager?

A wealth manager is a dedicated financial advisor who provides specialized wealth management services to clients with high net worth. By considering your investment objectives and aspirations, a wealth manager offers valuable guidance and a variety of supplementary services to enhance your financial well-being. Wealth managers can operate independently, as small-scale businesses, or as part of larger firms. You can receive personalized services from an individual wealth manager or a team of experts within a wealth management firm.

What Do Wealth Managers Do?

Private wealth managers play a crucial role in assisting individual investors in maximizing the advantages and navigating the intricacies of financial markets. They provide guidance and counsel to private individuals with significant wealth and affluent families, and they typically offer a range of services, including portfolio management, estate and retirement planning, and tax services.

Wealth managers provide holistic financial advice to help their clients grow and protect their wealth. Their services go beyond just providing advice on a client's investments or designing a financial plan for them. Wealth managers generally work with clients with a higher net worth than a financial planner might. They often work with professionals in related areas such as tax professionals and attorneys to help design a comprehensive wealth-planning strategy for their clients.

Financial advisor and private wealth manager

Wealth managers and financial advisors are closely related and share similarities in their roles. Both professionals assist clients in managing their finances and achieving their financial goals. They provide personalized guidance and expertise in areas such as investment management, retirement planning, tax strategies, and risk assessment. And their ultimate aim remains the same: to help clients optimize their financial well-being and make informed financial decisions based on their unique circumstances and goals.

What Differs Between a Wealth Manager and a Financial Advisor?

Although both roles involve financial matters, their areas of expertise differ slightly. Wealth managers specialize in managing the assets of affluent individuals, while financial advisors provide financial assistance to individuals regardless of their net worth.

Private wealth managers typically serve higher-net-worth clients, while financial advisors may have clients with a range of assets from $100,000 to $5 million. Private wealth managers often have a more intensive focus on asset management and may work with clients who have upwards of $20 million.

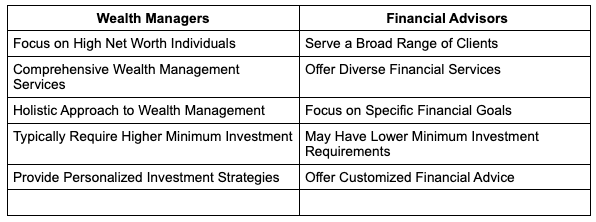

Here is a tabulated summary of five key differences between wealth managers and financial advisors:

Please note that these differences are generalizations, and there can be variations in the services and offerings provided by individual wealth managers and financial advisors.

Private Wealth Manager vs. Financial Advisor Fees

The significant disparity in fees lies in the percentage charged for assets under management (AUM). While wealth managers generally levy up to 3% or higher on AUM, financial advisors tend to cap it at 2% or even less, particularly for larger AUM amounts. This substantial difference in fee structures highlights one of the key distinctions between these two financial professionals.

Who is a financial planner?

Financial advisors and financial planners are professionals that people also mix up. But there are important differences between these two. While every financial planner is considered a financial advisor, not all financial advisors are financial planners.

A financial planner is an individual advisor who assists clients in managing their financial matters and working towards their long-term financial objectives. Financial planners help clients develop customized programs to achieve their financial goals. They may provide comprehensive financial guidance or specialize in specific areas.

On the other hand, the term "financial advisor" encompasses a wide range of professionals who offer financial guidance to individuals.

Wealth Management vs. Financial Planning Fees

The fees associated with wealth management are generally higher compared to those of a financial planner, as wealth management offers a broader range of specialized services. The fees charged by financial planners can vary depending on the specific needs of the client and the expertise of the financial professional.

Do you need wealth management or financial advisory services?

If you possess a high net worth and desire comprehensive financial management, it is advisable to consider engaging a wealth manager. Nonetheless, it is crucial to take into account the minimum asset requirement for opening an account when evaluating a wealth manager or any other financial advisor.

Pick the right expert

When searching for financial planning or wealth management firms, in addition to seeking recommendations from loved ones, consider searching online. Associations such as the National Association of Personal Financial Advisors (NAPFA) provide free databases of financial advisors.

Bay Street Capital Holdings is home to one of the leading wealth management teams in the US. Led by a trusted financial advisor, the firm provides excellent financial services. Contact us today and take advantage of our services to reach your financial goals.

Bay Street Capital Holdings

Bay Street Capital Holdings, situated in Palo Alto, is a reputable wealth management firm specializing in financial planning, wealth management, and investment advisory services. What sets them apart is their distinctive approach of effectively managing overall risk and volatility, rather than solely focusing on maximizing returns.

Under the leadership of esteemed founder William Huston, who was honored as one of Investopedia's Top 100 Financial Advisors for 2021, Bay Street stands out as one of the two Black-owned firms among the nineteen recognized in California. Their noteworthy collaboration with Resthaven Properties in the real estate industry has earned them a finalist position in the Asset Managers: Diversity, Equity, and Inclusion category at the 2023 WealthManagement.com Industry Awards.

The company's commitment to diversity and support for emerging fund managers and entrepreneurs is evident through their selection as a finalist in the Corporate Social Responsibility (CSR) category for the Asset Manager in 2021. This recognition came after competing against over 900 firms nationwide, demonstrating their dedication to making a positive social impact.

Sources

https://www.dbs.com/in/treasures/articles/role-of-a-wealth-manager

https://www.cfainstitute.org/en/programs/cfa/charterholder-careers/roles/private-wealth-manager

https://www.financestrategists.com/wealth-management/wealth-management-vs-financial-planning/