How Racism and Stereotypes in Finance Impact the Lives of Black Women Whitepaper

Abstract

This paper analyzes how racism and stereotypes in finance affect the lives of Black women.

We analyze the ratio of Black women currently in America, their representation in the U.S. workforce, their overall numbers in the finance sector and their representation in the finance

industry.

It is evident that the low number of Black women, especially in top management positions in finance stems from the challenges that come with being racially profiled.

In order for significant change to happen, financial inclusion needs to be a center of focus in the finance industry.

William Huston, AIF®, AIFA®

Table of Contents

1. Introduction

2. Definition of Racism & Stereotypes

3. Composition of the U.S. Population by Race

4. Black Women in the U.S. Labor Force

5. Labor Force Participation among Black Women

6. Number of Black Women in Finance in the U.S.

7. How Racism & Stereotypes in Finance Impact the Lives of Black Women

8. What Companies can do to Tackle Racism & Stereotyping among Black Women

9. 11 Successful Black Women in Finance that You Can Look Up to

10. Conclusion

Introduction

In 2022, it is very shocking to realize that only 2 out of the 44 women who are CEOs of Fortune 500 companies are Black. In the C-suite level, women of color represent only 4% of these

positions.

Is it a matter of lack of qualifications or a diversity issue? And what impact do such numbers have on Black women?

In this paper, we take a look at how racism and stereotypes in finance impact the lives of Black women.

Definition of Racism & Stereotype

Racism

Racism refers to a process in which opportunities are structured, policies are implemented, and actions and attitudes are tailored in a way that they create unequal opportunities and different outcomes for people based on race (3).

Racism occurs when prejudice against an individual or institutional is accompanied by the power to discriminate against, oppress or limit the rights of others (3).

Stereotype

A stereotype is a preconceived notion or assumption about a person or group of people; where the belief is that all people or things within a particular group share the same behaviors and

features, despite their personal characteristics (4).

While stereotypes can be positive, negative or neutral, all three forms can lead to negative results or they can be used to educate and sensitize different groups of people (4).

Composition of the U.S. Population by Race

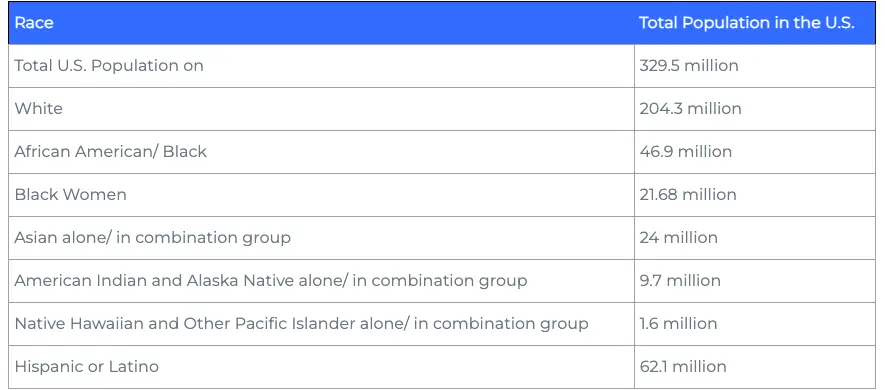

According to data from the 2020 census:

- The total population of the U.S. was at 329.5 million (5).

- People who identify as White comprised 204.3 million people. They remain to be the largest race or ethnicity group in the U.S. (6).

- The African American/ Black population comprised 46.9 million people, making them the second-largest race in the U.S. Out of the 46.9 million Black people, it is estimated that 21.68 million are women. That means Black men add up to a total of 25.22 million (6).

- Those identifying as Asian alone or in combination group comprised 24 million people (6).

- American Indian and Alaska Native alone or in combination group comprised 9.7 million people (6).

- The Native Hawaiian and other Pacific Islander alone or in combination group comprised a total of 1.6 million people (6).

- The Hispanic/ Latino population comprised 62.1 million (6).

Black Women In The U.S. Labor Force

In 2022, it is indicated that 46.6% of the U.S. labor force is female (7).

Labor force refers to the total number of people in a country or region who are physically able to do a job and are available for work. It is the total number of both employed and unemployed

persons (8,9).

As of March 2022, it is estimated that women's labor force participation rate was at 56.8% as compared to that of men which was at 67.9% (10).

According to the U.S. Bureau of Labor Statistics, the labor force participation rate represents the number of people in the labor force as a percentage of the civilian non-institutional population. In other words, the participation rate is the percentage of the population that is either working or actively looking for work (11).

Labor Force Participation Among Black Women

According to data from the Bureau of Labor Statistics (BLS), 397,000 women from age 20 and above joined the labor force in May 2022. This number represents those that are currently

working and those that are looking for work (12).

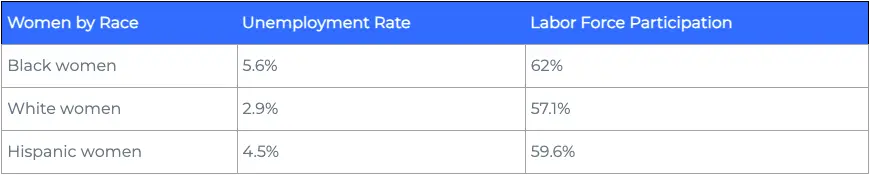

As of June 2022, it is reported that:

- The unemployment rate for Black women fell to 5.6% in June as the labor force participation rate also fell to 62% from 63% in May 2022. This is an indication that more Black women are leaving employment as compared to White and Hispanic women. This could be a result of the inequities that Black women face in the employment sector (13).

- On the other hand, the unemployment rate for White women was at 2.9% and the labor force participation rate held steady at 57.1% (13).

- Among Hispanic women, the unemployment rate went down to 4.5% as labor force participation hovered at 59.6% (13).

Number of Black Women in Finance in the U.S.

It is no secret that the finance industry in the U.S. is largely male-dominated. In finance, female representation declines as you go up the career ladder. The numbers reduce even more

drastically at the level of senior management.

According to a survey by McKinsey, women don't climb the corporate ladder as fast as men do. That's why, Black women and women of color are underrepresented at the levels which are above entry level (14).

A research done by Mckinsey also indicated that women accounted for about 52% of the finance industry, at the beginning of 2021. However, their representation fell at every step up the corporate ladder (15).

In the C-suite level, White men represent 64% while 23% are White women. People of color hold the least number of positions on this level. 13% of C-suite positions are held by men of color while a meager 4% are held by women of color (15).

In 2022, a record high of six Black CEOs are heads of Fortune 500 companies, making up just over 1% of businesses on the 2022 ranking. Out of the 6, only 2 are Black women - Walgreens’ CEO Roz Brewer and TIAA CEO Thasunda Brown Duckett. This marks a slight increase from 2021 when only five Black CEOs headed Fortune 500 companies (16).

As much as these are steps in the right direction, there's still a lot more work to be done in order to increase diversity in such high level positions (16).

How Racism & Stereotypes in Finance Impact the Lives of Black Women

Racism and stereotyping not only affects the mental well being of Black women, but it also determines the experience that they have at the workplace.

Here are some ways in which Black women in finance are impacted by these two negative

factors.

Work related stress

The "angry Black woman" stereotype perpetuates the assumption that Black women are aggressive, have a bad temper and are hostile. For Black women working in finance, this can lead to increased stress levels and anxiety (1, 17).

This is because expressing one's anger is a natural thing, regardless of their race. However, many Black women are forced to suppress such feelings in order to avoid being labeled as the angry Black woman. Suppressing one's emotions might lead to bottling up unnecessary feelings, difficulty in dealing with tough situations at work and strained relationships with co-workers. Eventually, this can lead to poor performance at work as a result of them feeling constrained (18, 19).

Difficulty in finding mentors

In some career fields that are male/ White dominated like construction and engineering, it can be difficult for Black women to find a mentor whom they identify with.

Mentors are important as they help you navigate work and life situations. It is important for Black women to have mentors who look like them and have gone through similar experiences as

them. Such mentors can help Black women gracefully navigate tough situations and get into spaces and industries that they would otherwise not have an entry point (18, 19).

Overrepresentation in minimum-wage jobs and minimal representation in the C-suite

Black women make up roughly 7% of the total workforce in the U.S. However, they account for approximately 12% of the minimum wage earners.

Regardless of the fact that Black women have moved into diverse career fields, they still tend to be over-represented in jobs that pay minimum wage and have barely any significant

representation in the C-suite. In 2022 for example, only 4% of C-suite positions are held by women of color and only 1% are Black women. Among the Fortune 500 companies, out of the 6

Black CEOs, only 2 are Black women - Walgreens’ CEO Roz Brewer and TIAA chief executive Thasunda Brown Duckett.

The effects of this imbalance were felt greatly especially during the pandemic where Black women in these minimum wage jobs experienced job loss. Job loss weighs more heavily on Black women as they are more likely than White women to be the sole or primary breadwinner in their household (18, 19).

Black women face a greater variety of microaggressions and instances of everyday racism

According to NPR, microaggressions are defined as the everyday, subtle, intentional and oftentimes unintentional interactions or behaviors that communicate some sort of bias toward historically marginalized groups (20).

From being labeled as overly assertive or aggressive to colleagues from other races making comments about Black women's hair and how it should look in a work setting; these are just but among the microaggressions that Black women face in their places of work.

At times it even goes as far as people openly expressing surprise when they see Black women in competitive careers or when they demonstrate strong language skills and are competent in their different areas of work. Taylor Sledge, the VP of Real Estate at Bay Street Capital Holdings shares that "I have experienced stereotyping as a Black woman in finance. For example, sometimes when I explain what I do for work, I'm always met with shock and surprise that I would be in such a competitive field, where I am a minority racially and as a woman. I feel that this has caused a lot of self doubt as a result of being expected to not succeed."

Ila Corcoran, the SVP Real Estate Operations & Advisory Services at Bay Street Capital Holdings shares that “As a black woman in finance, I’ve encountered various experiences where my knowledge and capability seemed to be in question. I remember entering a zoom meeting with another person, a person who happened to be White and male, who opened with

“I’m probably going to ask questions you don’t know the answer to.” Starting a meeting with such an immediate expectation of my inability to meet his needs and knowledge level struck me. I had never previously had a one on one meeting with this person, and he seemed to believe I

would be unable to perform. Why? The apparent reason was my appearance. This was not someone with whom I’d divulged my past job history or discussed credibility. My lack thereof

was assumed by him nonetheless.”

Entering spaces wherein I feel undermined before I’ve even had the chance to speak can be a frustrating uphill battle. At the same time, learning how to communicate through adversity and

excel even on uneven ground has been a great test of resilience for me. I hope that through increased representation and a growing intention towards equal treatment in all industries, we

can reestablish the way black women are perceived in historically white environments.

Such negative behaviors can lead to them performing averagely at work because they are not in the best mental state to maximize their potential. Microaggressions can also lead to them suppressing their ideas and contributions in the organization as they may feel like they don't belong, or as if their contributions don't matter (18, 19, 20).

Bias and systemic barriers in hiring and promotions

Despite Black women having the highest labor force participation rate among all women and being highly educated and qualified, they still face discrimination when it comes to the hiring and promotion processes at work.

In White dominated workplaces, Black women may not be the first choice when it comes to hiring because of racial bias. White people are more likely to hire people who look and think like them. Even when it comes to promotions, people with the same background as the recruiter(s) are more likely to get the promotion.

It is estimated that 47% of Black transgender women report being fired, denied a promotion, or not hired because of their gender identity (18, 19, 20).

Black women often find that they are the only Black person in the room

In the workplace, at meetings and in networking circles, Black women often find that they are the only ones of their race in the room.

To add on to that, Black women have to deal with the pressure of repackaging themselves into a character that seems less problematic and more approachable to their White counterparts. From how they speak, to how they dress to how they wear their hair, Black women are forced to adapt to a different form of themselves because of how they are perceived.

This is exhausting for Black women and it causes stress and anxiety to Black women because they are unable to be themselves and have to conform to certain standards in order to appear more competent, capable and welcoming to their colleagues (18, 19, 20, 21).

Black women are paid less as compared to their white counterparts

For every 1 dollar paid to a White man, a Black woman receives 63 cents. Black women are often paid less because some of their White counterparts believe that Black women cannot be

as competent, intelligent and skilled as compared to white females who are on the same level as them (22).

It is reported that Black women make nearly $1 million less than White men during their careers. The factors that eventually lead to this include subtle doubts about the competence of Black

women, their intelligence and skill level.

Long term, this leads to the racial wealth gap widening even further (18, 19, 20).

What Companies can do to Tackle Racism & Stereotyping among Black Women

Starting the tough conversation on race and keeping it going

Having difficult conversations about race at work is very important because for a lot of people, racial matters are intertwined with pain, injustice and discomfort.

In as much as conversations on racial matters might spark a lot of emotion, if handled sensitively they can help people connect and empathize as they share their different lived experiences.

It is important to acknowledge the injustices that are currently being experienced by Black women and other people of color and what companies and organizations can do to promote

equal and fair workplaces for Black women.

When companies ensure that Black women are represented at all levels of the organization and include them when opportunities arise, this leads to a healthier and more productive work environment for Black women (23, 24).

Implement fair recruitment and promotion practices

Implementing fair recruitment processes that eliminate barriers to entry is one of the ways that companies can ensure they promote fairness as well as attract the best talent in the market.

In all recruiting processes, there should be clear guidelines on the levels of diversity that are required. This will ensure that Black women are fairly included and represented.

When it comes to promotion practices, it is vital that companies have fair and transparent promotion processes in order to ensure that Black women are able to leverage the same

opportunities as their other team members (23, 24).

Setting up employee resource groups to support Black women

Companies and organizations should make it a point to create employee resource groups for Black women at the workplace so that they can get the support that they need.

With the presence of ERGs, Black women will be able to feel a sense of belonging in the organization. In such forums, Black women can document their experiences, challenges, feedback and recommendations and share with company management, if they deem it appropriate (23, 24).

In the long run, this feedback could help the organization ensure that:

- Black women are included in the organization's decision making

- Their voices are heard and their views are listened to

- They provide emotional and psychological safety to Black women when uncomfortable experiences arise

- Systemic barriers that have hindered the professional growth of women are dismantled

Making diversity a priority and tackling issues of unconscious bias

Within organizations, management may be perpetuating racism and stereotyping unknowingly. Leaders of organizations do have a lot of influence on company culture and therefore, when

they take a firm stand against racism and stereotyping the same culture is likely to trickle down to the rest of the company members.

It is therefore vital that leaders take time to initiate continuous and meaningful conversations about diversity and inclusion and also ways to ensure that the same is reflected in their various

teams (23, 24).

Being more thoughtful with how company finances are used

Investing in Black women beyond just your organization is a step in the right direction, when it comes to tackling matters racism and stereotyping.

By taking a stand and working with Black female advisors or donating to charitable organizations that are run by Black women - these are some of the ways in which companies

can take part in fighting racism and stereotyping.

By doing so, the resources spent benefit a Black woman and other people of color in extension (23, 24).

Despite the challenges that Black women face in their pursuit of careers in the financial field, here are 10 successful women that continue to break the glass ceiling.

11 Outstanding Black Women Setting the Pace in Finance

1. Ila Corcoran

Ila is the SVP, Real Estate Operations & Advisory Services at Bay Street Capital Holdings. She got into the real estate industry after her family experienced foreclosure. As a result of this, she opted to become an investment advisor who focused on real estate transactions, at a pretty young age. She began her journey as a realtor with a great interest in helping BIPOC families secure housing.

Over time, her career path has taken many forms. She started out in apartment management and leasing and then later transitioned to become a residential real estate agent. She wanted to develop career capital that would propel her into the opportunities systematically unavailable to her community.

With a desire to be at the forefront of innovative solutions to a traditional industry, Ila’s career developed substantially during her work with a start-up focused on a modern approach to

buying, selling, and financing real estate. Ila worked as a key stakeholder in developing a platform of over 70,000 real estate professionals, helping them and their clients maximize their

investments.

Driven by the need to help people create security through housing and home ownership, Ila worked with 9 of the leading home builders in Southern California for a year, facilitating the

purchase and sale of newly constructed housing and starting a real estate portfolio of her own. For 2 years she’s worked closely with homeowners and real estate professionals to help them maximize their investments, and avoid the threats of discount buyers and/or foreclosure. In 2021 alone, she led a team to close more than $80m in transaction volume across numerous states.

She is taking new clients in 2022 who are interested in working on their real estate needs and or financial goals. She is of the belief that financial/ housing security is a right that all people

deserve.

During her free time, she enjoys serving apartment communities across Los Angeles that are dedicated to helping those experiencing homelessness (25).

2. Taylor Sledge

Taylor is the VP, Real Estate Operations at Bay Street Capital Holdings. Based in Southern California where she specializes in the housing market, her interest in real estate started back in

grade school where she would spend weekends with her stepfather exploring the beautiful homes in the opulent neighborhoods of Long Beach, like Bixby Knolls.

She obtained her Real Estate License during her final year of undergrad at California State University of Long Beach, where she also received a Bachelor’s of Science in Criminal Justice.

Taylor is always up for a challenge and because of that, she’s continuously researching new markets in order to expand her knowledge base. By doing so, she is developing the capacity to

serve clients throughout all of Southern California at a high level.

Prior to joining Bay Street Capital Holdings, Taylor was the Chief of Staff of a boutique real estate investment firm and the Community Manager of Vector90, a co-working space in the

Crenshaw District of South Los Angeles.

During her free time, she enjoys roller skating, spending time with family and keeping up with the latest binge worthy series (25).

3. Carla Harris

Carla Harris is a Senior Client Advisor at Morgan Stanley. With 30+ years of experience in the financial industry, she has had extensive industry experiences in the technology, media, retail,

telecommunications, transportation, industrial, and healthcare sectors.

Formerly, she headed the Emerging Manager Platform, the equity capital markets effort for the consumer and retail industries and was responsible for Equity Private Placements.

Notably in 2013, Ms. Harris was appointed by President Barack Obama to chair the National Women’s Business Council (28).

4. Edith Cooper

Edith Cooper is the Co-founder of Medley, a company that's focused on creating environments where people can perform to their potential. She remains to be one of the leading Black business executives in America, having spent 30 years of her career working in Wall Street (32).

Formerly a Senior Director at Goldman Sachs, she currently serves on the boards of:

- Amazon

- PepsiCo

- EQT Partners

- The Museum of Modern Art

- The Smithsonian National Museum of African American History and Culture

- Mount Sinai Hospital

5. Kahina Van Dyke

Kahina is among the leading Black women in Fintech with over 20 years of experience in

banking and technology.

She is currently the Global Head of Digital Channels and Data Analytics in Corporate,

Commercial & Institutional Banking, Standard Chartered, spearheading their vision to become

the leading digital banking platform powering global trade, commerce and financial services.

Previously, she has held senior management positions at Facebook, MasterCard and Citibank.

Kahina has been an independent board director of Progressive Insurance, a Fortune 100

company since 2018, and a former Board Observer of MoneyGram International after leading

the successful minority stake investment of that company in 2019. She was named #1 Global

Woman in Fintech in 2019 by the Financial Technology Report and has received multiple

awards for services to technology and finance. She is a sought-after keynote speaker to

entrepreneurs, leaders of industry and government officials (33).

6. Mellody Hobson

Mellody Hobson is the Co-CEO of Ariel Investments, a mutual fund company & investment

management firm based in Chicago.

In addition to being an advocate of financial literacy among African Americans, she also serves

as the Chairman of the Board of Trustees of the Ariel Investment Trust - the company’s publicly

traded mutual funds.

She's also currently the Chair of Starbucks Corp; the first African American woman to be

appointed as chairperson of an S&P 500 company (26).

7. Olayinka Odeniran

Olayinka is the Founder and Chairwoman of Black Women Blockchain Council. As a highly

respected compliance, cyber security and risk management expert with over 16 years of

experience in compliance, she helps financial firms navigate through domestic and international

regulations.

The mission of Black Women Blockchain Council as a platform is to provide educational events,

resources to train Black women in the technological understanding of the distributed ledger

technology, and promote Black-women-led Blockchain projects.

The aim of the platform is to increase the number of young girls and Black women involved in

blockchain, fintech, and other emerging technologies (34).

8. Sheena Allen

Sheena Allen is the founder and CEO of CapWay, a fintech startup company. CapWay is a

mobile app that offers specialized financial services to individuals who don't have access to

banks. It also connects millennials and Gen-Zs to the cashless economy. The company is on a

mission to serve people who lack fair opportunity and access to mainstream financial services.

So far she is the youngest woman in America to own and operate a digital bank (31).

9. Suzanne Shank

Starting off as an engineer in her early professional life, Suzanne Shank later transitioned into

the finance industry after earning an MBA from Wharton.

She currently serves as the CEO and a co-founder of Siebert Williams Shank & Co., LLC. The

investment banking firm was established in 1996 and has consistently ranked among the most

active underwriters of publicly traded equity, investment grade corporate debt and municipal

debt offerings.

Ms. Shank has been recognized as a leader in the financial services industry by many

publications some of which include Crain’s New York, U.S Banker Magazine, the Municipal

Forum of New York, Black Enterprise, Ebony Magazine, among others.

In 2020, she was named one of USA Today’s Women of the Century in 2020 (29).

10. Thasunda Brown Duckett

Thasunda Brown Duckett is President and Chief Executive Officer of TIAA. TIAA is a leading

provider of secure retirements and outcome-focused investment solutions to individuals as well

as institutions.

Previously, she served as Chief Executive Officer of Chase Consumer Banking, where she

oversaw a banking network with more than $600 billion in deposits and 50,000 employees.

As a person who is passionate about helping communities of color close achievement gaps in

wealth creation, educational outcomes and career success, she applies the same values in

TIAA, as its leader.

She also serves on the boards of:

- NIKE, Inc.

- Brex Inc.

- Robert F. Kennedy Human Rights, Sesame Workshop

- National Medal of Honor Museum, Economic Club of New York

- University of Houston Board of Visitors

- Dean’s Advisory Board for Baylor University’s Hankamer School of Business.

As TIAA’s CEO, Duckett continues to leads the company from a financial inclusion standpoint

(30).

11. Valerie Mosley

Valerie Mosley is the Founder and CEO of Valmo Ventures, an investment company that is

focused on creating, collaborating, and investing in companies, assets and efforts that add

value to portfolio returns and add value to the society (27).

She also currently serves on the boards of:

- Eaton Vance’s family of mutual funds

- Dynex, a NYSE mortgage REIT

- Progress Investment Management Company, a privately held Fund of Funds

- New York State’s Common Retirement Pension Fund Investment Advisory Committee

Conclusion

Financial inclusion is important for racial equity to be achieved. Fair representation of different

races and genders in finance is vital in order to ensure that the voices of women and people in

BIPOC communities are heard.

In the words of Bärí A. Williams, the COO of Bandwagon Fan Club. Inc. "Diversity gets people in

the door; inclusion keeps them there.”

Bay Street Capital Holdings

Bay Street Capital Holdings is an independent investment advisory, wealth management, and

financial planning firm headquartered in Palo Alto, CA. They manage portfolios with the goal of

maintaining and increasing total assets and income with a high priority on managing total risk

and volatility. Although many advisors may focus on maximizing returns, they place a higher

priority on managing total risk and volatility.

Bay Street Capital Holdings is an independent investment advisory, wealth management, and

financial planning firm headquartered in Palo Alto, CA. They manage portfolios with the goal of

maintaining and increasing total assets and income with a high priority on managing total risk

and volatility. Although many advisors may focus on maximizing returns, they place a higher

priority on managing total risk and volatility.

Bay Street was founded to advocate for diverse and emerging fund managers and

entrepreneurs. In 2021, Bay Street was selected as a finalist out of over 900 firms across the

US in the category of Asset Manager for Corporate Social Responsibility (CSR).

Sources

- J. Celeste Walley-Jean. (2009). Debunking the Myth of the “Angry Black Woman”: An Exploration of Anger in Young African American Women. Black Women, Gender + Families, 3(2), 68–86.https://www.jstor.org/stable/10.5406/blacwomegendfami.3.2.0068

- https://news.stanford.edu/2018/06/11/four-ways-human-mind-shapes-reality/

- https://humanrights.gov.au/our-work/race-discrimination/what-racism

- https://study.com/academy/lesson/stereotyping-in-the-workplace-definition-examples-effects.html#:~:text=Stereotypes%20are%20assumptions%20made%20about,affiliation%20with%20a%20certain%20group.

- https://www.commerce.gov/news/blog/2022/02/national-black-history-month-us-census-bureau-releases-key-stats-nations-black

- https://www.census.gov/library/stories/2021/08/improved-race-ethnicity-measures-reveal-united-states-population-much-more-multiracial.html

- https://www.zippia.com/advice/what-percentage-of-the-workforce-is-female/

- https://www.collinsdictionary.com/dictionary/english/workforce#:~:text=workforce%20%2F%CB%88w%C9%9C%CB%90k%CB%8Cf%C9%94%CB%90s%2F%20NOUN-,The%20workforce%20is%20the%20total%20number%20of%20people%20in%20a,American%20English%3A%20workforce%20%2F%CB%88w%C9%9Crkf%C9%94rs%2F

- https://www.bls.gov/cps/lfcharacteristics.htm#laborforce

- https://www.bls.gov/cps/lfcharacteristics.htm#laborforce

- https://nwlc.org/resource/womens-labor-force-participation-increases-as-397000-women-join-labor-force-in-may/

- https://www.cnbc.com/2022/07/08/unemployment-rate-for-black-women-fell-in-june-but-so-did-their-participation-in-the-labor-force.html

- https://www.americanbanker.com/list/where-gender-and-racial-gaps-persist-in-financial-services-and-why

- https://www.mckinsey.com/industries/financial-services/our-insights/closing-the-gender-and-race-gaps-in-north-american-financial-services

- https://fortune.com/2022/05/23/meet-6-black-ceos-fortune-500-first-black-founder-to-ever-make-list/

- https://news.ubc.ca/2022/01/24/angry-black-woman-stereotype/

- https://leanin.org/black-women-racism-discrimination-at-work#

- https://www.brookings.edu/essay/women-are-advancing-in-the-workplace-but-women-of-color-still-lag-behind/

- https://www.npr.org/2020/06/08/872371063/microaggressions-are-a-big-deal-how-to-talk-them-out-and-when-to-walk-away

- https://www.elle.com/life-love/a33419444/black-women-white-colleagues-workplace-discrimination/

- https://www.cnbc.com/2021/08/03/black-women-make-1-million-less-than-white-men-during-their-careers.html

- https://www.cipd.co.uk/Images/tackling-racism-in-the-workplace-hr-leader-resource-pack_tcm18-89741.pdf

- https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/594336/race-in-workplace-mcgregor-smith-review.pdf](https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/594336/race-in-workplace-mcgregor-smith-review.pdf)

- https://www.baystreetcapitalholdings.com

- https://www.arielinvestments.com/content/view/138/1838/

- http://www.valmoventures.com/team/valerie-mosley/

- https://carlaspearls.com/about-carla/

- https://www.siebertwilliams.com/suzanne-shank-bio

- https://www.tiaa.org/public/about-tiaa/leadership-team/thasunda-brown-duckett

- https://www.sheenaallen.com/about

- https://www.withmedley.com/about-us

- https://www.sc.com/en/people/kahina-van-dyke/

- https://bwbc.io/board-bio/

WHAT WE'RE THINKING

Let's Talk

Schedule a complimentary consultation with one of our advisors to learn more about Bay Street and how we can help you achieve your goals for your financial future.