Hey prudent investor,

This week’s commentary highlights investments in our strategy that have appreciated or dropped more than 10% during the course of the week.

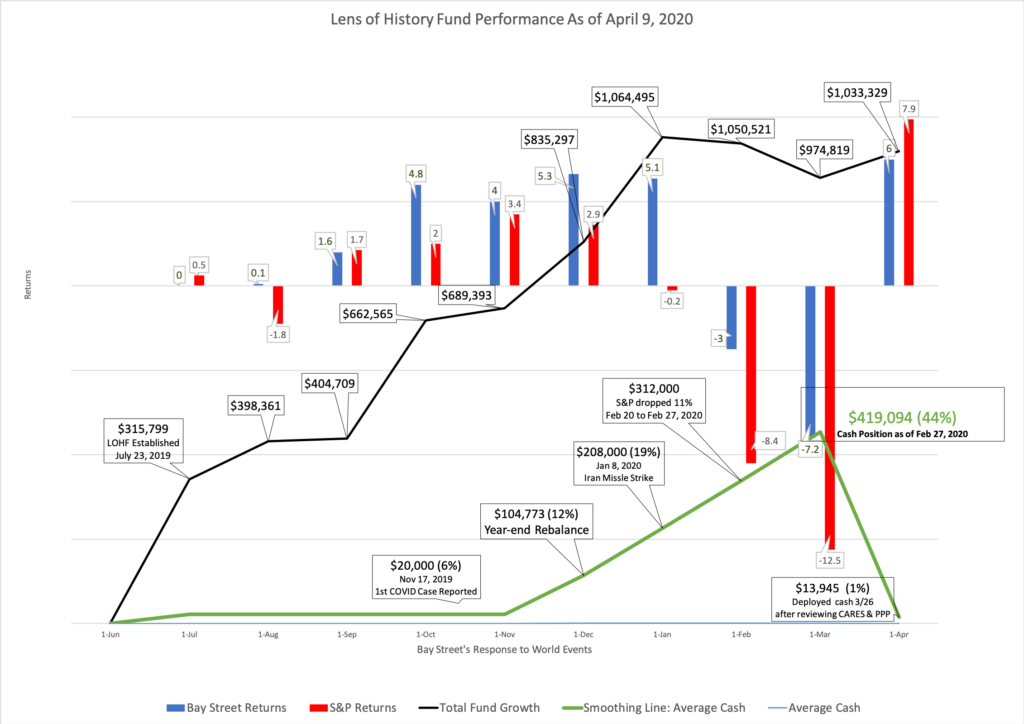

In addition, while the market remains in a state of heightened volatility, every week we will finish each commentary with an update on the performance of our Lens of History Fund and my brief perspective on calibrating for what lies ahead.

This week, we will be introducing an opportunity zone investment that allows for tax deferral until 2026 and no taxable gains if held for 10 years or more. Please review the attachment “BSCH_OZ.” I hope you find this commentary useful.

Square (SQ) 29% gain

Square (SQ) traded up 29% after a large percentage of businesses that use Square applied for the $350 billion available through PPP (Paycheck Protection Program). Jack Dorsey, the co-founder of Twitter and founder of Square, announced that he is donating $1 billion of his personal shares of Square, more than a quarter of his wealth, for COVID-19 relief efforts.

Brookfield Asset Management (BAM) 20.14% gain

Brookfield Asset Management Inc. is an alternative asset management company focusing on real estate, renewable power, infrastructure, and private equity. The company’s headquarters are located in Toronto, and it also has corporate offices in New York City, London, Rio de Janeiro and Sydney.

Vanguard Tax-Managed Small Cap Fund (VTMSX) 19.39% gain

As part of Vanguard’s series of tax-managed investments, this fund offers investors exposure to small-capitalization stocks. Its unique, index-oriented approach attempts to track the benchmark while keeping taxable gains to a minimum.

Lam Research Corporation (LRCX) 15.79% gain

Lam Research was upgraded from neutral to buy by Instinet’s announcement that “Lam’s stock was currently trading at a substantial discount to where it was at the beginning of the calendar 2020.” Bay Street took a position in LRCX on 3/26. 3 weeks prior to this announcement.

Oaktree Capital Group (OAK-A) 15.11% gain

Oaktree Capital Management is an American global asset management firm specializing in alternative investment strategies. It is the largest distressed securities investor in the world, and one of the largest credit investors in the world.

Brookfield Renewable Partners LP (BEP) 13.21% gain

Brookfield Renewable Partners L.P. is a publicly-traded limited partnership that owns and operates renewable power assets, with corporate headquarters in Toronto, Canada. It is 60% owned by Brookfield Asset Management.

Tesla (TSLA) 12.4% gain

Tesla has been the most volatile stock in our portfolio for 2020. I took a position at $495 and decided to hold the position when we reduced our market exposure by shifting $419,000 to cash in preparation for a sharp correction. Fundamentally, I am expecting Tesla to outperform for years to come, so instead of selling the position and creating unnecessary trading fees for our clients, I decided to hold it with the expectation that it would not fall too far from our initial entry point. So far, that thesis has held.

ServiceNow (NOW) 11.42% gain

ServiceNow has continued to appreciate during the COVID-19 crisis. They will announce first-quarter earnings on April 29. ServiceNow, Inc. is an American cloud computing company with its headquarters in Santa Clara, California.

Apple (AAPL) 10.40% gain

Apple is still the United States’ most valuable company. As such, it should be viewed from the macro perspective of supply and demand. COVID-19 has obviously affected the supply chain in China. Demand has also been temporarily depressed as a result of reduced spending on non-essential goods. My perspective is that Apple will continue to expand its subscription-based services like Apple TV, Apple Music, and iCloud to support its biggest moneymaker, the iPhone.

Honorable Mention: NextEra Energy Inc (9.52%) gain

Because our Lens of History Fund is over-weighted towards renewable energy, we will also mention NextEra’s performance this week. They will announce first-quarter earnings on April 22. NextEra Energy, Inc. is a Fortune 200 energy company with about 45,900 megawatts of generating capacity, revenues of over $17 billion in 2017, and about 14,000 employees throughout the United States and Canada. It is the largest electric utility holding company by market capitalization.

Although last week proved to be a strong week across the market, I believe it is fair to expect the markets to be considerably lower in the near term. Our goal is to invest in opportunities that through the lens of history are a good value today, regardless of the potential for further near term volatility.

Bay Street’s total fund appreciated by $115,376 over the last week and we are currently fully deployed in equity positions. At the end of next week, we will rebalance $250,000 of capital into the attached Block 216 Qualified Opportunity Fund. Block 216 is an opportunity zone investment building a Ritz-Carlton in Portland OR. This provides a significant opportunity for our clients because we will defer all capital gains on current returns for the next 6 years and avoid all taxable gains for all clients who hold the investment for the next 10 years.

If you would like to diversify your portfolio and participate in this offering, please contact me directly.

William Huston, AIF® Director, Institutional Services 650-464-8275 – – –

Bay Street’s statements are not an endorsement or a recommendation to buy or sell specific securities. Prudent investors should consider the appropriate risks and seek professional advice for their unique situation. This attachment does not constitute an offer to sell or solicitation of an offer to buy securities. Any attachment is not a prospectus or advertisement, and the offering is not being made to the general public. This Offering is available only to “accredited investors” as such term is defined in Rule 501(a) of Reg D under the Securities Act of 1933.