Hey prudent investor,

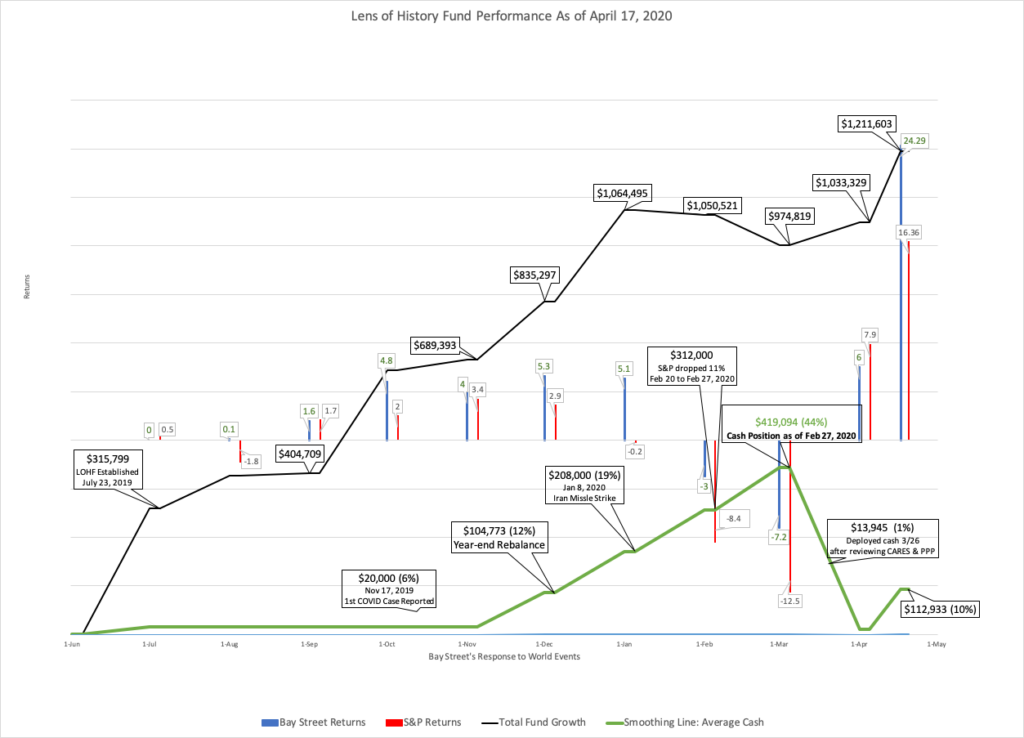

Bay Street’s total fund appreciated by $178,274 (24.29%) from 4/13 to 4/17. We are currently 90% deployed in equity positions. This week marks 3 full quarters (270 days) since launching the fund. For comparison, $100,000 in our fund would have appreciated by 23.9%. The S&P has returned -3.7% over the same 270-day period.

This commentary covers the investments in our strategy that have appreciated or dropped more than 10% during the course of the week.

Tesla (TSLA) 27.54% gain

Following off last week’s 12.4% gain, Telsa is up another 27.54% this week. Chinese car registrations rose 450% between February and March. Goldman Sachs also released a new price target of $864. We’ve maintained a 14% position since January.

Advanced Micro Devices 16.92% gain

AMD advanced this week in anticipation of its upcoming 4/28 quarterly earnings report.

Learning opportunity: AMD is currently selling near all-time highs with a relative strength index (RSI) of 94, which is in overbought territory of 70 RSI. When a stock is overbought, it means too many people are buying, which presents a temporary selling opportunity. For context, the last earnings call on 1/28, AMD was sitting at 25 RSI, which is below oversold territory of 30 RSI. These two factors suggest that if AMD does not present an attractive earnings report, the stock will probably drop back into its average price territory of $48. I’ll review the outcome after 4/28.

DexCom (DXCM) 15.55% gain

DexCom has continued to outperform. We took the position 3/26 when we deployed capital and clients have enjoyed a 29.25% gain. DexCom is currently trading at its highest price since the 2007 IPO, after receiving FDA approval to use its continuous glucose monitors on COVID-19 patients. DexCom is also currently in overbought territory (103 RSI), which suggests a short term movement back to the $260-$280 range depending on the 4/28 earnings report.

More on RSI next week!

This Tuesday, Lydia Idem will provide commentary on Telsa. Thursday, Tanner Gish will review historical trends and provide perspective on the current state of the market.

Although last week proved to be another strong week across the market, I still believe it is fair to expect the markets to be considerably lower in the near term. Our goal is to invest in opportunities that through the lens of history are a good value today and an excellent investment for the future, regardless of short term volatility.

– – –

Bay Street’s statements are not an endorsement or a recommendation to buy or sell specific securities. Prudent investors should consider the appropriate risks and seek professional advice for their unique situation. Certain securities are exclusive to “institutional investors” and/or “accredited investors” defined in Rule 501(a) of Reg D under the Securities Act of 1933. Any attachment does not constitute an offer to sell or solicitation of an offer to buy securities. Any attachment is not a prospectus or advertisement. Certain securities are available to the general public.