Abstract

In this paper, we take a look at the state of businesses owned by founders in the BIPOC community in the U.S. and the unique challenges that they face as founders of color.

The paper highlights 2022 VC funding data for BIPOC led organizations, examines why a gap exists and the steps that can be taken for racial equity investing to take place.

Fair distribution of VC funds is vital as it could eventually contribute to closing the existing wealth gap.

Table of Contents

- Introduction

- The state of businesses owned by founders in BIPOC communities in the U.S.

- 2022 VC Funding Data For BIPOC-Led Organizations

- Challenges Faced By BIPOC Founders of Investment Firms

- What Racial Equity Investing Looks like in Practice

- Role That VC and investment firms can Play for Fair Funding Across the BIPOC Investment Community

- Conclusion

Introduction

Small businesses in the U.S. are the key drivers of the U.S. economy. They help greatly in keeping the American dream alive.

A small business as defined by The Small Business Administration (SBA) refers to a firm that has fewer than 500 employees.

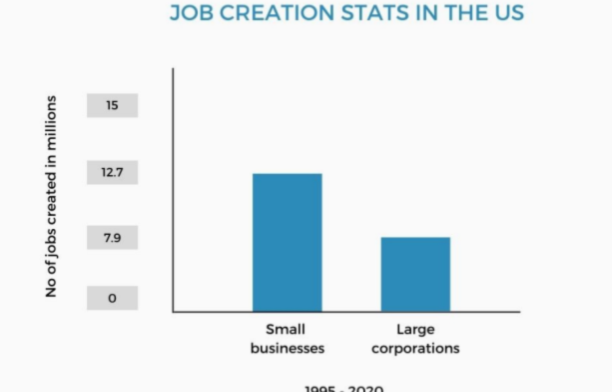

Small businesses accounted for 62% of new jobs created between 1995-2020. This is an equivalent of 12.7 million jobs, compared to the 7.9 million jobs that are created by larger corporate entities.

According to a 2019 SBA report, small businesses accounted for 44% of the economic activity in the U.S.

In 2021, the SBA indicated that the number of small businesses in the U.S. was 33.2 million and they accounted for 99.9% of all businesses in the U.S. (1, 3).

Breakdown of BIPOC Owned Businesses In The U.S.

- In 2022, the number of small businesses stood at approximately 33.2 million (1).

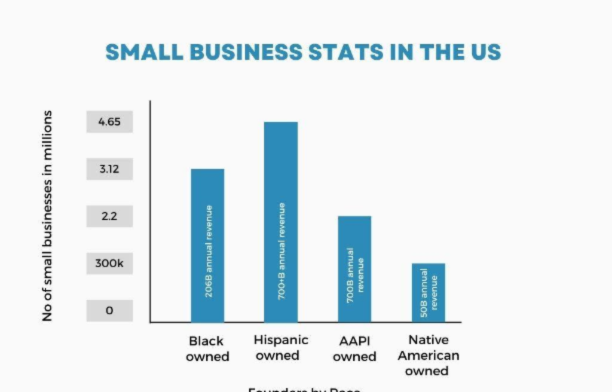

- Out of the 33.2 million small businesses, roughly 3.12 million are Black-owned businesses, generating $206 billion in annual revenue (4).

- Approximately 4.65 million small businesses are Hispanic-owned, generating about $700+ billion in annual revenue (5).

- Approximately 2.2 million small businesses are owned by people in the AAPI (Asian American and Pacific Islander) community, generating $700 billion in annual revenue (6).

- There are about 300,000 Native American-owned small businesses, generating around $50 billion of revenue a year (7).

That is a strong indication that without small businesses, the American economy would not be what it is today.

The State Of Businesses Owned By Founders In BIPOC Communities In The U.S.

It has been established that small businesses are key drivers of the economy. However people in BIPOC (Black, Indigenous, and people of color) communities have consistently been faced with challenges when it comes to running successful businesses in the U.S.

Access to funding, unconscious, systemic inequalities, inflation, labor shortages and supply chain disruption caused by the pandemic are some of the barriers that have caused the racial wealth gap to widen over time.

According to Mckinsey's Company, it is estimated that closing the Black–White and Hispanic–White racial wealth gaps would boost consumption and investment within the U.S. economy by an additional $2-3 trillion. That’s equivalent to 8-12% of U.S. GDP (8).

2022 VC Funding Data For Bipoc-led Organizations

2022 is not looking good for BIPOC founders looking to get VC funding.

According to Crunchbase data:

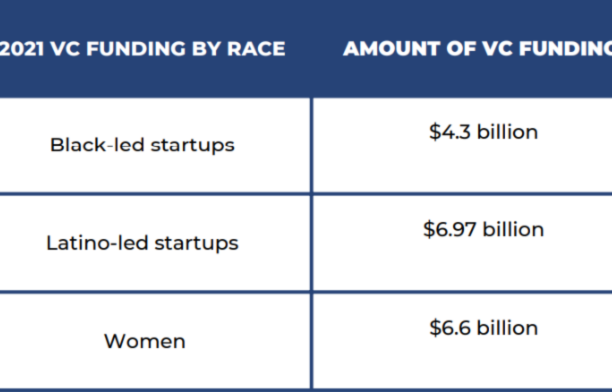

- In Q2 of 2022, it is reported that Black startups received $324 million in VC funds, a significant decrease from the $1.2 billion received in Q1. In 2021, companies with Black founders received roughly $4.3 billion in the U.S (9, 20).

- On the other hand, Latino founders received 2.1% of venture capital funding. That roughly sums up to $6.97 billion out of a total of $330 billion (10).

- In 2021, it is reported that women raised just 2% of the record $330 billion in venture capital (9, 20).

- Of that 2%, less than 0.50% went to Black women, approximately 0.51% went to Latino founders, roughly 0.71% went to Asian women, and a meager 0.004% went to Indigenous founders (9,20).

Challenges Faced By BIPOC Founders Of Investment Firms

Racial Bias

According to the U.S. Bureau of Labor Statistics (BLS), it is estimated that 20% of new businesses fail during the first 2 years of being open, 45% during the first 5 years, and 65% during the first 10 years. Only 25% of new businesses make it to the 15+ year mark.

Research has it that the increased rate at which BIPOC founders are starting their own businesses could eventually close the racial wealth gap.

Starting a business in general is a risky activity. For founders in BIPOC communities, it’s an even riskier affair. The stakes are high and if you succeed, this may lead to upward wealth mobility. However, when founders in BIPOC communities fail, the implications on them are much higher. This is because of high interest loans that they have in form of debt that they have to pay back, the high economic cost associated with business closure and also because they face more discrimination when attempting to access funding to re-start or revive their businesses. This in turn leads to downward wealth mobility in BIPOC communities (11,19).

Limited Access To Capital And Funding

Systemic racism and racial bias are just but among the reasons why BIPOC founders of investment firms find it challenging to access funding that they need to either start or scale their firms.

Historically, obtaining traditional bank loans for small businesses has been difficult. With the current economic state, things have become even more difficult. Some of the barriers that make it hard for BIPOC founders to access funding are:Historically, obtaining traditional bank loans for small businesses has been difficult. With the current economic state, things have become even more difficult. Some of the barriers that make it hard for BIPOC founders to access funding are:

- Small community banks have decreased in number since the great recession of 2008.

- The service industry is expanding rapidly, and a lot of businesses in this space use a cash flow business model.

- With VC firms, the major focus is usually on high growth potential businesses.

Without proper funding, it is difficult for other aspects in the business to run. Hiring the right team, purchasing software or material that you may need and also doing proper digital marketing might become almost impossible with very little resources. This in turn greatly affects how such companies are run and to the magnitude at which they can scale (11,19).

Lack Of Representation

A lack of representation for people in BIPOC communities is another issue that continues to linger in the investment sector.

Following the murder of George Floyd in 2020, many companies spoke out against racism and some even pledged to foster diversity in their institutions. Since then, time has passed but asset managers are struggling to keep these promises.

By the end of 2021, a U.S. House financial services committee reported on 31 investment firms with $47 trillion in assets. The findings indicated a serious lack of diversity in the firms. Within those 31 investment firms, it was reported by the committee that more than 4 out of 5 of their senior managers were White, and only about 3 in 100 were Black.

Without proper representation in these top positions, employees from BIPOC communities have a harder time when it comes to climbing the corporate ladder. This is because they have nobody to show them the ropes.

According to a research report by Willis Towers Watson (an investment consultancy), it is reported that diverse investment teams tend to perform better than those who don't include women or people from BIPOC communities (11,19).

What Does Racial Equity Investing Look Like In Practice?

Step 1: Creating Forums To Learn

Racial matters are very complex and sensitive. As a first step to promoting racial equity investing, it is important that investor companies and venture capitalists commit to discussing racial equity and investing at committee and board meetings so that there can be a clear understanding of how investments can either provide solutions or propagate racial inequality.

How people in leadership positions perceive race can affect company processes like hiring, selection of managers or company leaders, risk assessment as well as selection of experts or consultants to work with, for things like trainings.

All company staff, from the top managers to the employees should be involved in the learning process when it comes to racial matters. They also need to be equipped with tools to navigate tough situations that may arise.

Considering diversity of stakeholders when making investment decisions can be very helpful as organizations are able to identify overlooked opportunities.

Companies should also make a conscious effort of diversifying their boards and investment committees. This will ensure that the decisions made are fair to all the concerned parties (2).

Step 2: Building Consensus

Investor companies looking to promote racial equity should have a general agreement on which investment strategies to implement so that they are able effectively push the DEI agenda.

The same way investment companies are keen to invest in companies that have a functioning ESG framework in place, they should also be keen on investing in companies that have a comprehensive racial equity strategy or policy in place. There should also be ways of evaluating the implementation of these racial equity policies.

By heads of VC firms and investor companies championing this move, diversity and inclusion practices are more likely to be implemented. This approach long term could lead to racial equity (2).

Step 3: Evaluating And Updating Existing Policies

With a clear direction on the next strategic steps, an investor company can go ahead and review and update its existing investment policy statement in order to implement investing practices that reflect diversity and inclusion.

A clear and flexible racial equity policy that accommodates rising diversity and inclusion needs as the company grows, can be very beneficial when it comes to setting the institution's goals and objectives. It can also come in handy when it comes to identifying new opportunities in the market (2).

Step 4: Investing And Engaging

Another way in which investors can promote racial equity investing is to engage asset managers in investment firms, who are part of the BIPOC community about the approach that they take when it comes to the implementation of diversity and inclusion within their internal teams.

For investment firms led by people in BIPOC communities, it is important to find out things like: if the company has a DEI policy, the percentage of board members who are part of the BIPOC communities and also what percentage of their current assets under management are managed by firms led by people in BIPOC communities.

Investing in companies led by people in the BIPOC community can help an investor company gain new perspective when it comes to portfolio management. This is because the perspective of people of color is usually rooted in respect for other people's cultures and lived experiences (2).

Step 5: Iterating & Sharing

To promote racial equity investing, it is important that investors evolve and participate in conversations that touch on diversity and equity that are happening worldwide.

With the ever changing trends, managers and firm leaders should take the initiative of adjusting the different portfolios for financial alignment.

Also, the efforts being put in place to promote DEI practices should be shared publicly in the organization and the progress disclosed to the public. By doing so, VC and investor companies will be encouraging transparency and accountability to the society (2).

Role that VC and Investment Firms can Play for Fair Funding across the BIPOC Investment Community

Investing In Companies With BIPOC Leaders

If VC firms invest in companies led by founders from BIPOC communities, it can lead to great social change. This is because studies have shown that many people tend to build their relationships and networks within their ethnicity or race.

Therefore, by investing in firms led by BIPOC founders, the positive effects will trickle down to investees, employees of the firm and also communities of color, through increased jobs or investment opportunities (2,11).

Making A Conscious Effort To Reach Outside Of Their Existing Network

VC firms can make a conscious effort to invest in business outside of their already existing network in an effort to be more inclusive and diverse.

Partnering with founders in BIPOC communities can open up the gateway to investment opportunities for other similar organizations (2,11).

Providing Space For Ideation In A Healthy Environment

For entrepreneurs to succeed, an enabling environment is very important. Venture capitalists can use their resources and networks to creatively provide resources to BIPOC founders. This will go a long way in their journey (2,11).

Provide Access To Mentors And A Supportive Community

By VC firms opening up their networks to BIPOC founders, this can open doors for even the next generations to come. Investors that have access to key mentors, stakeholders and supportive communities can be a powerful source of inspiration to BIPOC founders (2,11).

Top VC Firms That Provide Funding For Founders In BIPOC Communities

As of May 2022, VC funding stood at $39 billion. This marks a 20% decrease from May 2021 where VC funding stood at a total of $49 billion.

Less than 10% of all venture capital deals go to Women, People of Color, and LGBTQIA+ founders. Other VC firms may perceive this as a problem in the pipeline. However, for VC firms led by BIPOC leaders, they see it as a great investment opportunity.

Here are 7 excellent BIPOC-led VC firms that support founders of color.

Brown Venture Group

Brown Venture Group, LLC is a venture capital firm that exclusively supports Black, Latino and Indigenous technology startups. Founded by Dr. Paul Campbell, the firm mainly targets inventors in the tech space who are looking to create startups in emerging technologies (12).

Black Angel Tech Fund

Black Angel Tech fund was established in 2015 after a thought provoking panel about the lack of Black tech entrepreneurs and the abundance of potential Black Angel investors, at the Stanford Black Alumni Summit. The fund supports Black-owned startups (13).

Backstage Capital

Backstage Capital was founded by Arlan Hamilton to serve women, people of color, and LGBT- owned startups. She was keen on serving these groups as they are the ones that have been overlooked and underestimated in society. She believes that by supporting these overlooked groups, the ethnic and gender gap will eventually be closed.

To date, Backstage Capital has invested in 200 companies that are led by diverse founders (14).

DigitalUndivided

Founded by Kathryn Finney in 2012, Digitalundivided is on a mission to champion Black- and Latinx-owned startups by women. The company works by providing the necessary funds and important advice that will help these businesses launch and scale.

The vision of the company is to create a space in the world where women own their work (15).

EchoVC Partners

EchoVC Partners is a VC firm that finances diverse founding teams. The company majorly works with women and under-represented founders specifically of African descent. They also provide their services in markets where people of color are underserved and they support bold ideas and business models that leverage technology to deliver value to mass markets (16).

Harlem Capital Partners

Based in New York, Harlem Capital Partners is a venture capital firm that is on a mission to revolutionize entrepreneurship by investing in 1,000 diverse founders over 20 years. They work with women and founders from minority communities who are working towards enhancing financial, marketing and operational experiences (17).

Fearless Fund

This venture capital firm helps women of color access Series A, pre-seed, and seed-level funding. By providing them with funding, the company positions these entrepreneurs and their firms to become even more attractive for further venture investment.

Fearless Fund's mission is to bridge the significant gap in investment funding for Black women founders and enable them to build growth-aggressive and scalable companies (18).

Conclusion

Funding across the BIPOC community is not only necessary, but it is also a way to bridge the racial wealth gap that currently exists.

For the U.S. economy to operate at an optimal level, VC funding has to be fairly distributed to founders in BIPOC communities too. In the same breath, BIPOC leaders have to put in conscious effort to elevate those in their communities in order to be able to occupy more space in the investment world.

Bay Street Capital Holdings

Bay Street Capital Holdings is a Black-owned, independent investment advisory, wealth management, and financial planning firm headquartered in Palo Alto, CA. They manage portfolios with the goal of maintaining and increasing total assets and income with a high priority on managing total risk and volatility. Although many advisors may focus on maximizing returns, they place a higher priority on managing total risk and volatility.

Our founder, William Huston founded Bay Street after 13 years of supporting the United States' largest retirement plan ($650B) Thrift Savings Plan. He is recognized as Investopedia’s Top 100 Financial Advisors for 2022. In California, Bay Street Capital Holdings is the only Black-owned firm out of the twenty firms that received this recognition.

In Scottsdale Arizona, Ekenna Anya-Gafu CFP, AAMS is recognized among the Best Financial Advisors for his responsiveness, friendliness, helpfulness, and detail. Bay Street was founded to advocate for diverse and emerging fund managers and entrepreneurs. In 2021, Bay Street was selected as a finalist out of over 900 firms across the US in the category of Asset Manager for Corporate Social Responsibility (CSR).

SOURCES

1.SBA. https://www.sba.gov/

2.Intentional Endowments Network: Investing in Racial Equity: A Primer for College & University Endowments. https://d3n8a8pro7vhmx.cloudfront.net/intentionalendowments/pages/5506/attachments/original/1597944875/Investing_in_Racial_Equity-Primer_for_College___University_Endowments.pdf?1597944875

3.Forbes: How Small Businesses Drive The American Economy. [https://www.forbes.com/sites/forbesbusinesscouncil/2022/03/25/how-small-businesses-drive-the-american-economy/?sh=2203341c4169](https://www.forbes.com/sites/forbesbusinesscouncil/2022/03/25/how-small-businesses-drive- the-american-economy/?sh=2203341c4169)

4.Brookings: Black-owned businesses in U.S. cities: The challenges, solutions, and opportunities for prosperity. [https://www.brookings.edu/wp-content/uploads/2022/02/Black-business-report_PDF.pdf](https://www.brookings.edu/wp-content/uploads/2022/02/Black- business-report_PDF.pdf)

5.U.S. Small Business Administration. https://www.sba.gov/about-sba/organization/observances/hispanic-heritage-month#:~:text=There%20are%20an%20estimated%204.65,segment%20of%20U.S.%20small%20businesses](https://www.sba.gov/about-sba/organization/observances/hispanic-heritage-month#:~:text=There%20are%20an%20estimated%204.65,segment%20of%20U.S.%20small%20businesses)

6.NBC News: 90+ AAPI-owned businesses to support in 2022. https://www.nbcnews.com/select/shopping/aapi-owned-businesses-ncna1268981

7.SBA: How SBA Helps Native American Small Business Owners Succeed. https://www.sba.gov/blog/how-sba-helps-native-american-small-business-owners-succeed#:~:text=American%20Indians%2C%20Alaska%20Natives%2C%20and%20Native%20Hawaiians%20have%20a%20strong,billion%20of%20revenue%20a%20year

8.Mckinsey & Company: America 2021: The opportunity to advance racial equity. https://www.mckinsey.com/bem/our-insights/america-2021-the-opportunity-to-advance-racial-equity

9.TechCrunch: Black founders are seeing a decrease in funding amid economic downturn. https://techcrunch.com/2022/06/17/black-founders-are-seeing-a-decrease-in-funding-amid-economic-downturn/

10.Wired: Latino Founders Have a Hard Time Raising Money From VC. https://www.wired.com/story/latino-founders-hard-raising-money-vcs/

11.Mission Investors Exchange: Investing In and With Entrepreneurs and Leaders of Color. https://missioninvestors.org/resources/investing-entrepreneurs-and-leaders-color

12.Brown Venture Group: https://brownventuregroup.com/

13.Black Angel Tech Fund: https://www.blackangeltechfund.com/

14.Backstage Capital: https://backstagecapital.com/

15.Digital Undivided: https://www.digitalundivided.com/

16.EchoVC: https://www.echovc.com/

17.Harlem Capital: https://harlem.capital/

18.Fearless Fund: https://www.fearless.fund/

19.Mckinsey & Company: Building supportive ecosystems for Black-owned US businesses. https://www.mckinsey.com/industries/public-and-social-sector/our-insights/building-supportive-ecosystems-for-black-owned-us-businesses

20.Crunchbase: VC Funding To Black-Founded Startups Slows Dramatically As Venture Investors Pull Back. https://news.crunchbase.com/venture/something-ventured-funding-to-black-startup-founders-quadrupled-in-past-year-but-remains-elusive/