Bank returns show that not all lenders are equal.

The time to invest in banks with a stock-picking strategy has arrived. That was the lesson Friday morning, when the three major U.S. lenders announced fourth-quarter results. Over the past two years, investors have been rewarded for investing heavily in this sector, with the SPDR S&P Bank (KBE) ETF up 28%. Investors who bought at the region's March 2020 lows are rewarded with higher returns. Even in the first two weeks of the year, banks did well: the Bank ETF was up 10%, outperforming the S&P 500's 2.2% loss.

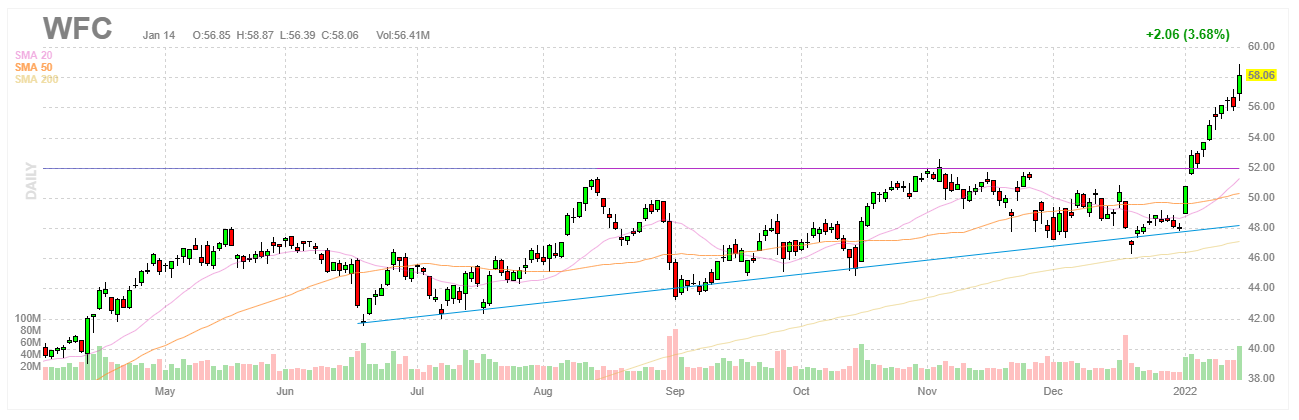

But with the sector in the driver's seat after the pandemic, banks are no longer betting on economic recovery. This makes the question of who is the best in the post-pandemic world even more important to investors. Take a look at the immediate stock reaction to last quarter's results from JPMorgan Chase (stock ticker: JPM), Citigroup (C) and Wells Fargo (WFC). JPMorgan has been the favorite through most of the pandemic due to increased trading activity and trade execution, but with trading levels falling from pandemic highs, it looks like it's time for other banks to shine.

After Friday's open JPMorgan shares fell 5 percent , while Citigroup shares fell 1.9 percent. Wells Fargo was the exception, up 2.6 percent. In the end, JPMorgan lost 6.2 percent, Citigroup lost 1.3 percent, and Wells Fargo lost 3.7 percent. Here's what we've learned so far about bank earnings and lender performance in a few key areas.

Credit growth remains a wild card. Based on Friday's results, while investors eagerly anticipate that banks will post higher loan growth, they may have to wait a bit longer. Loan Growth has stagnated - and, in some cases, slowed - During the pandemic because businesses and households felt too nervous to borrow, or setan flooded dine dine dinearro cuand was the winner, JPM. 6% year after year. The bank's wealth and asset management division posted an 18% increase, mainly thanks to securities lending. Credit card and auto lending also increased.

At Wells Fargo, loan balances are down 3% since the end of last year, even though the bank experienced a rebound in lending in the second half of 2021. Citigroup experienced a 1% decline in its annual loan balance. The increase in loan growth should help banks, especially as the Federal Reserve prepares to raise interest rates this year. This will widen the gap between the interest banks earn on loans and the interest they pay on deposits. Costs have risen. And while investors may be willing to wait a bit longer for loan growth to pick up, they appear to have been less tolerant of increased spending.

JPMorgan announced higher-than-expected costs due to compensation, marketing and technology costs. Worse, the bank said it expects full-year spending to grow about 9% to $77 billion in 2022. Citigroup also reported an increase in spending. It jumped 18% due to recent divestitures and the bank's attempt to optimize operations after regulators issued a sign-off order in October 2020 over weaknesses in the bank's internal controls.

Wells Fargo went against the grain, cutting spending 11% year over year due to fewer employees from the company's sales and less reliance on outside consultants. Wells Fargo's efficiency ratio, a measure of cost to revenue, has improved, falling to 63% from 80% last year. weak trading. Economic turbulence for most of the past two years has allowed banks to derive most of their profits from business growth, but those days may be over.

Both JPMorgan and Citigroup posted an 11% drop in trading revenue, and both banks' fixed income fell by double digits. Wells Fargo's operating earnings were flat year over year. Wall Street will learn more about what's in store for banks when Goldman Sachs (GS), Bank of America (BAC) and Morgan Stanley (MS) report results next week.

SOURCE

English, C. (2022, January 14). Banks’ Earnings Show Lenders Aren’t All the Same. It’s Time to Pick and Choose. Barron’s. Retrieved January 17, 2022, from https://www.barrons.com/articles/citi-jpm-well-fargo-bank-earnings-51642178051?siteid=yhoof2