10 Best Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms have emerged as game-changers in the world of real estate investment. They have revolutionized the way individuals participate in the market in a bid to build their real estate portfolios.

With their innovative approach, these platforms have opened up new avenues for both seasoned real estate investors and newcomers, providing access to lucrative real estate opportunities that were once exclusive to wealthy individuals or institutional investors.

In this blog, we shall cover the top real estate investment platforms that are worth checking out in 2023.

Key Takeaways

- Real estate crowdfunding platforms are revolutionizing the way individuals participate in the market in a bid to build their real estate portfolio

- Among the top real estate crowdfunding platforms include: AcreTrader, Arrived Homes, CrowdStreet, DiversyFund, EquityMultiple, First National Realty Partners, Fundrise, PeerStreet, RealtyMogul and Yieldstreet

- As a real estate investor, be sure to consult with a financial advisor and real estate professional as well as do thorough research before making any investment in real estate crowdfunding platforms

Disclaimer

The contents of this article are for educational purposes only. They are not intended to be a source of professional financial advice. You will find experts on financial planning and financial management here. More on disclaimers here.

What is Real Estate Crowdfunding?

Real estate crowdfunding is a method of raising funds from a large number of individuals to finance real estate projects. It involves using online platforms that connect investors with real estate developers or property owners.

Through these real estate crowdfunding sites and platforms, investors can contribute relatively small amounts of money and become shareholders or lenders in specific real estate ventures. In return, they may receive a share of the profits, rental income or interest payments generated by the property.

What are Real Estate Crowdfunding Platforms and How Do They Work?

Real estate crowdfunding platforms are online platforms that facilitate the investment process for both real estate developers or property owners and individual investors. These platforms act as intermediaries, connecting these two parties and enabling them to transact and collaborate on real estate projects.

How they typically work is that:

- Real estate developers or property owners submit their project proposals to the real estate crowdfunding site or platform, providing details such as location, property type, investment amount, expected returns and other relevant information.

- The platform then conducts a thorough evaluation of the project, assessing factors like the developer's track record, market analysis, financial viability and legal compliance. They may also verify the developer's credentials and conduct site visits.

- Once a project passes the platform's due diligence process, it is listed on the platform's website. Investors can review the project's details, including the investment amount per share, projected returns and any associated risks.

- Interested investors can then select the projects they wish to invest in and contribute funds through the platform. Depending on the platform and the specific project, investors may have options such as equity investments (owning a share of the property) or debt investments (providing a loan to the developer).

- If the project meets its funding goal within a specified timeframe, the funds are transferred to the developer. The developer then proceeds with the real estate project, whether it's property acquisition, development or renovation.

- Throughout the project's lifecycle, the crowdfunding platform keeps investors informed about its progress, providing regular updates, financial reports and any other relevant information. Investors may receive returns in the form of rental income, profit distributions or interest payments, depending on the structure of the investment.

- Once the real estate project is completed or reaches a predetermined milestone, investors may have options to exit their investment. This can include selling their shares to other investors on the platform or through other mechanisms facilitated by the platform.

It's important to note that specific procedures and terms can vary among different real estate crowdfunding platforms. Investors should carefully review the platform's offerings, as well as their terms and conditions before making any investment decisions. Be sure to speak to a financial advisor. or real estate professional before making any investments, so they can offer you some guidance.

10 Best Real Estate Crowdfunding Platform

1. AcreTrader

- Fees : 0.75% annual management fees

- Minimum investment : $10,000

- Accredited investors only : Yes

Founded in 2018, AcreTrader is a real estate crowdfunding platform that is focused on investing in farmland. With the use of tech, the company provides investors with an easy way to invest in high quality farmland with the aim of supporting the business of farming.

So far, AcreTrader has invested in 131 properties and has raised a total of $320M+ in equity.

Pros

- Investing in farmland through AcreTrader allows investors to diversify their portfolios.

- AcreTrader's team consists of experienced professionals with knowledge of farmland investments. They handle all aspects of the investment, including property selection, acquisition, leasing and ongoing management.

- The platform charges relatively low management fees.

Cons

- One has to be an accredited investor to invest in the platform.

- AcreTrader has a high minimum investment amount.

- The number of investment properties available are limited because of the slow vetting process.

2. Arrived Homes

- Fees : 1% in annual management fees

- Minimum investment : $100

- Accredited investors only : No

Arrived Homes is a crowdfunding platform that enables investors to easily invest in residential real estate. The goal of the company is to make the ownership of home and vacation rentals easier.

So far, the platform has funded 266+ properties and the value of property that has been funded through the platform stands at $97+ million.

Pros

- Arrived Homes provides access to a diversified portfolio of residential properties.

- The platform offers a lower minimum investment amount.

- Investors can potentially earn passive rental income generated by the properties in which they have invested.

Cons

- Real estate investments made through the platform are generally illiquid.

- Investors have limited control over the individual property selection and management decisions.

- Market risk as the performance of residential real estate is subject to market fluctuations, economic conditions and local market dynamics.

3. CrowdStreet

- Fees : 1% to 2% annual fee for asset management

- Minimum investment : $25,000

- Accredited investors only : Yes

CrowdStreet is a real estate crowdfunding platform that was established in 2013, and has its headquarters in Austin, Texas. The platform allows individual investors to easily access investment opportunities and also offers them the online tools needed to manage those investments.

So far, the platform has thousands of investors who have invested $4+ billion in more than 752 projects. The company is on a mission to deliver the best online real estate investing experience and make it easy for individual investors to diversify their portfolios.

Pros

- The platform provides investors with a user-friendly interface, regular updates on investments and access to resources and educational content.

- CrowdStreet offers a broad range of commercial real estate investment opportunities.

- The platform works with reputable real estate sponsors who have a track record of successful projects and industry expertise.

Cons

- CrowdStreet is limited to accredited investors only.

- Investors cannot make early withdrawals.

- Real estate investments made through CrowdStreet are typically illiquid.

4. DiversyFund

- Fees : 2% annual management fee

- Minimum investment : $500

- Accredited investors only : No

DiversyFund is a real estate crowdfunding platform that enables investors to primarily invest in commercial and multifamily residential real estate. The platform offers its clients the necessary tools and information to enable them start investing in private market assets in order to build wealth and diversify their portfolios.

Pros

The platform provides non accredited investors with access to investment opportunities in real estate, allowing them to diversify their portfolios and earn income.

Lower minimum investment requirements. The platform is ideal for passive investors as all aspects of the investment process, including property acquisition, management and potential sale are handled by the company.

Cons

Real estate investments made through DiversyFund are illiquid during the 5 year investment term.

The platform offers its investors limited investment options. Investors have limited control over the specific properties chosen for investment or the management decisions made by DiversyFund.

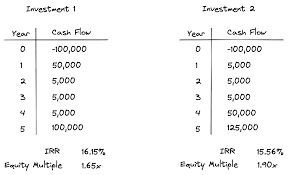

5. EquityMultiple

- Fees : Between 0.5% and 1.5% annual management fee

- Minimum investment : $5,000

- Accredited investors only : Yes

Equity Multiple is a crowdfunding platform that helps investors build wealth through streamlined access to diverse real estate investment products. The platform offers investors 17% total net return and the total project value currently stands at $4.4+ billion.

**Pros **

- EquityMultiple offers a range of commercial real estate projects.

- The platform partners with established real estate stakeholders who have a proven track record and industry expertise.

- The platform is easy to use.

Cons

- Only accredited investors can invest on this platform.

- Illiquidity which may make it challenging to sell or exit investments before the completion of the project or a designated holding period.

- High minimum investment fee.

6. First National Realty Partners

- Fees : Between 0.5% and 1.5% annual management fee

- Minimum investment : $50,000

- Accredited investors only : Yes

Accredited investors only: Yes

Founded in 2015, First National Realty Partners is a company that majorly invests in necessity-based commercial real estate properties such as grocery-anchored shopping centers and premium multi-family housing. So far, the company has $2 billion in assets under management and a total of 2360+ investors on the platform.

Pros

- The platform provides investors access to high quality commercial real estate investment opportunities.

- Investors can be able to diversify their portfolios thus earning more passive income.

- The platform allows investors to select the deals that best align with their investment needs.

Cons

- The platform has a relatively high investment minimum.

- First National Realty Partners is only accessible to accredited investors.

- Illiquidity of the real estate assets that the firm has invested in.

7. Fundrise

- Fees : 0.85% annual management fee

- Minimum investment : $10

- Accredited investors only : No

Fundrise was founded in 2012 and the firm has its headquarters in Washington, DC. The company leverages technology to offer its investors high quality real estate investments at an affordable cost.

Currently, the firm manages $3+ billion of equity on behalf of more than 387,000+ individual investors.

Pros

- The platform offers investment opportunities with lower minimum investment requirements, thus making it accessible to more investors.

- Fundrise is not limited to accredited investors only.

- The platform is user-friendly.

Cons

- Real estate investments through Fundrise are generally illiquid.

- The platform charges management fees which can affect the overall returns on your investments.

- Fundrise invests in different kinds of real estate and so investors have to do due diligence before investing in the platform.

8. PeerStreet

- Fees : 0.25% - 1.0%

- Minimum investment : $1,000

- Accredited investors only : Yes

Accredited investors only: Yes PeerStreet is an online marketplace that enables accredited investors invest in real estate debt. With the goal of building wealth and rebuilding the American neighbourhood, the platform gives private lenders access to capital which they then lend to real estate borrowers.

PeerStreet then collects monthly payments from the real estate borrowers and distributes a part of that monthly payment to the investors on the platform. As of 2022, the platform's average annual return was 6.49%.

Pros

- The platform is user-friendly.

- There is passive income potential for investors.

- The platform offers a variety of secure loans, and this allows investors to diversify their investment portfolios across various loan types and mitigate risk.

Cons

- PeerStreet is limited to accredited investors only.

- Real estate loans come with inherent risks, including the potential for borrower default.

- The platform only offers investments in debt, which can be a risky venture.

9. RealtyMogul

- Fees : 1% - 1.25% annual fee

- Minimum investment : $1,000

- Accredited investors only : No

RealtyMogul is a real estate crowdfunding platform that enables real estate investors to easily invest in commercial real estate and generate income. So far, the property value under the platform's portfolio stands at $5.9 billion.

Pros

- Diverse investment opportunities in commercial real estate investments.

- Transparency and due diligence as the platform provides detailed information on investment opportunities.

- RealtyMogul offers investment opportunities with relatively low minimum investment requirements.

Cons

- Real estate investments made through RealtyMogul are typically illiquid, and it may be challenging to sell or exit investments.

- The platform charges fees to investors and this can impact the overall returns on investments.

- RealtyMogul primarily focuses on commercial real estate projects which may limit the investment options for investors seeking diversification in different asset classes.

10. Yieldstreet

- Fees : 1% - 1.25% annual fee

- Minimum investment : $5,000

- Accredited investors only : No

Yieldstreet is a real estate crowdfunding site that empowers investors to grow their wealth outside the stock market by curating private market alternatives from top investment managers.

Pros

- Investors have access to diverse investment opportunities such as real estate, equity art, legal among others.

- Yieldstreet offers investment opportunities with relatively low minimum investment requirements, making it accessible to a broader range of investors.

- Exclusive access to offerings from top managers.

Cons

- Real estate investments made through Yieldstreet are typically illiquid.

- A lot of the available investments are only accessible to accredited investors.

- Investors have limited control over investment selection made by the fund managers.

Pros & Cons of Investing in Real Estate Crowdfunding Platforms

Investing in real estate crowdfunding platforms can have several benefits, but it's important to consider the potential drawbacks as well. Here are some pros and cons of investing in real estate crowdfunding platforms:

Pros

Access to a broader range of real estate opportunities . Real estate crowdfunding platforms provide access to a variety of investment opportunities that may not be easily accessible to individual investors. This allows you to diversify your real estate portfolio across different types of properties, locations and investment strategies.

Lower investment minimums . Real estate crowdfunding platforms often have lower investment minimums compared to traditional real estate investments. This allows investors to participate in real estate projects with smaller amounts of capital.

Passive investment . Investing through crowdfunding platforms allows you to be a passive investor. The platform handles property acquisition, management and other operational aspects, reducing the time and effort required on your part.

Potential for attractive returns . Real estate investments, if successful, can provide attractive returns through regular income distributions (such as rental income) and potential capital appreciation when the property is sold.

Transparency and information access . Crowdfunding platforms typically provide detailed information about the investment opportunities, including financial projections, property details and associated risks. This transparency helps investors make informed decisions.

Cons

Risk of loss . Real estate investments inherently involve risks, including the possibility of loss of capital. Property values can fluctuate, rental income may not meet expectations and unforeseen circumstances can impact the performance of the investment.

Lack of control . As a passive investor, you have limited control over the decision-making process and day-to-day operations of the property. You rely on the platform and project sponsors to make sound investment decisions and effectively manage the property.

Liquidity challenges . Real estate investments are typically illiquid, meaning it may be difficult to sell or exit your investment before the completion of the project or a designated holding period. Crowdfunding platforms may offer secondary markets, but liquidity can still be limited.

Platform risk . Investing through crowdfunding platforms exposes you to the risk associated with the platform itself. If the platform faces financial or operational difficulties, it could impact your investments and ability to access your funds. ** Regulatory considerations** . Real estate crowdfunding is subject to regulatory requirements, and the legal framework may vary across jurisdictions. It's important to understand the regulatory environment and ensure the platform you choose complies with applicable regulations.

How to Get Started in Real Estate Crowdfunding

To get started in real estate crowdfunding as an investor, follow these steps:

Step 1 : Research reputable real estate crowdfunding platforms that offer a variety of investment opportunities.

Step 2 : Evaluate the available investment options based on your investment goals and risk tolerance.

Step 3 : Conduct thorough due diligence on the platform and the specific investment opportunity, including the platform's track record and the project sponsor's expertise.

Step 4 : Register on the chosen real estate crowdfunding platform, providing the required identification and financial information.

Step 5 : Fund your account by depositing the desired amount of money.

Step 6 : Browse the available projects on the platform and carefully review their details, financial projections and associated risks.

Step 7 : Select an investment opportunity that aligns with your goals and preferences.

Step 8 : Make an investment by allocating your funds to the chosen project.

Step 9 : Monitor the progress of your investment and stay updated on project updates provided by the platform.

Step 10 : Reap the potential benefits, such as regular distributions, potential capital appreciation and the opportunity to diversify your real estate portfolio.

Before making any investment decisions, be sure to consult with a financial advisor and real estate professional, as well as do thorough research and due diligence. As an investor, carefully consider the risks involved in real estate crowdfunding before you jump into any opportunity.

Bay Street Capital Holdings

Bay Street Capital Holdings is an independent, Black-owned financial company that provides independent investment advisory, wealth management and financial planning services to enhance total assets and income while efficiently managing overall risk and volatility.

The company's founder, William Huston, has been recognized as one of Investopedia's Top 100 Financial Advisors for 2022. Bay Street Capital Holdings was established to foster diversity and aid emerging fund managers and entrepreneurs. Additionally, the firm was a finalist in the Asset Manager for Corporate Social Responsibility (CSR) category, out of more than 900 firms in the US.

In Scottsdale Arizona, Ekenna Anya-Gafu CFP, AAMS is recognized among the Best Financial Advisors for his responsiveness, friendliness, helpfulness and attention to detail.

Sources

https://www.investopedia.com/best-real-estate-crowdfunding-sites-5070790

https://www.nerdwallet.com/best/investing/real-estate-crowdfunding-platforms

https://www.benzinga.com/money/best-real-estate-crowdfunding-platforms

https://youngandtheinvested.com/best-real-estate-crowdfunding-sites-platforms/

https://sparkrental.com/real-estate-crowdfunding-investments/